New Bitcoin ATMs Signal Expansion of Crypto in Kenya

Kenya’s cryptocurrency landscape is facing its first major regulatory test as Bitcoin ATMs have been spotted in major shopping malls across Nairobi. This comes shortly after the implementation of the country’s Virtual Assets Service Providers Act (VASP Act) 2025, which establishes a legal framework for cryptocurrency operations.

Local reports confirmed the presence of new ATMs branded “Bankless Bitcoin” installed alongside traditional banking kiosks, offering cash-to-crypto services to the public. While Bitcoin ATMs have existed in Kenya in the past, their presence in mainstream retail spaces marks a significant development in crypto accessibility.

Licensing and Regulatory Oversight Still Pending

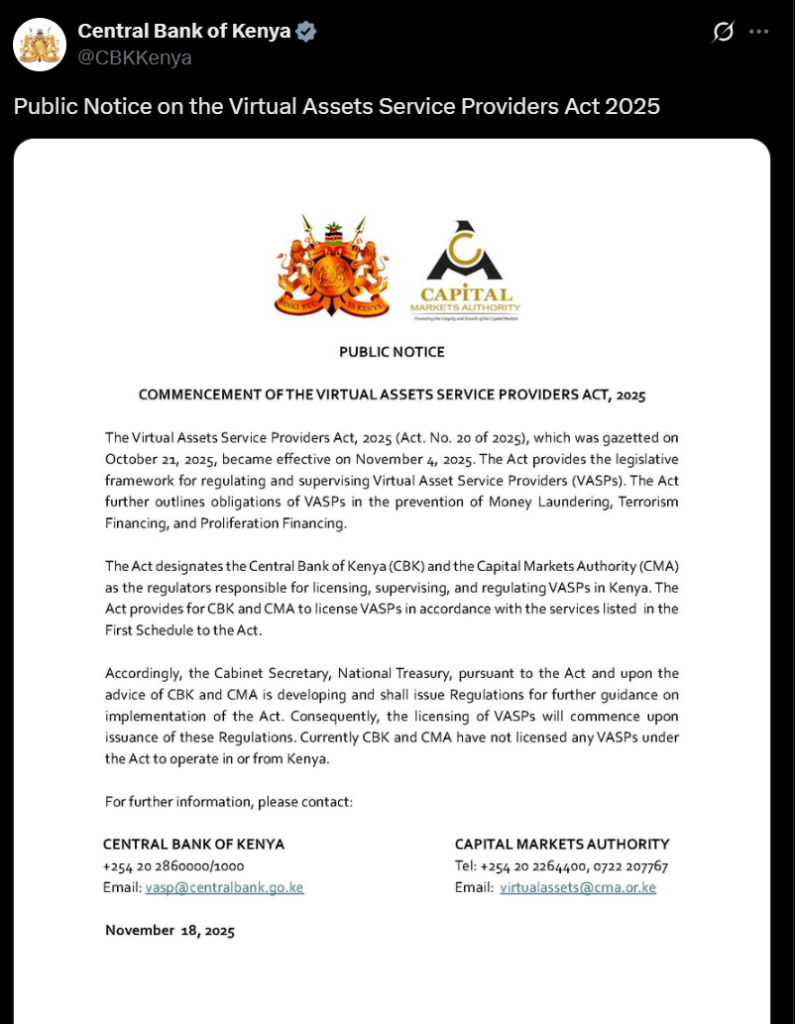

The VASP Act mandates licensing for wallet operators, exchanges, custodians, and other crypto service providers. However, regulators have not yet issued the regulations required to begin licensing. The Central Bank of Kenya (CBK) oversees payment and custody services, while the Capital Markets Authority (CMA) regulates investment and trading activities.

In a joint statement, both agencies emphasized: “Currently, CBK and CMA have not licensed any VASPs under the Act to operate in or from Kenya. Companies claiming authorization are operating illegally.”

The lack of active licensing has created a regulatory gap, with visible crypto infrastructure appearing in malls even as operators remain unauthorized. The National Treasury is reportedly finalizing the necessary regulations to start formal licensing.

Bitcoin Adoption Beyond Urban Centers

The emergence of ATMs in upscale malls reflects growing interest among Kenya’s middle- and upper-income populations. At the same time, Bitcoin has gained traction in informal settlements like Kibera, where residents often lack access to traditional banking.

“Residents can hold value without documentation or banking paperwork, providing them financial freedom,” said a co-founder of a local crypto firm, highlighting the practical benefits for people living on low incomes.

The arrival of Bitcoin ATMs underscores the tension between rapid crypto adoption and evolving regulatory frameworks. As Kenya’s authorities finalize licensing regulations, both the public and crypto providers must navigate a market that is expanding quickly yet remains legally uncertain.

Kenya’s crypto sector is at a crossroads, balancing innovation, financial inclusion, and compliance in a market under active development.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.