Payward, the parent company behind the Kraken, reported strong financial performance in 2025, posting a 33% increase in adjusted annual revenue. The growth was driven by higher trading activity, expanding customer accounts, and contributions from recent acquisitions, as the company continues to refine its long-term corporate strategy ahead of a potential public listing.

Full-Year Financial Performance

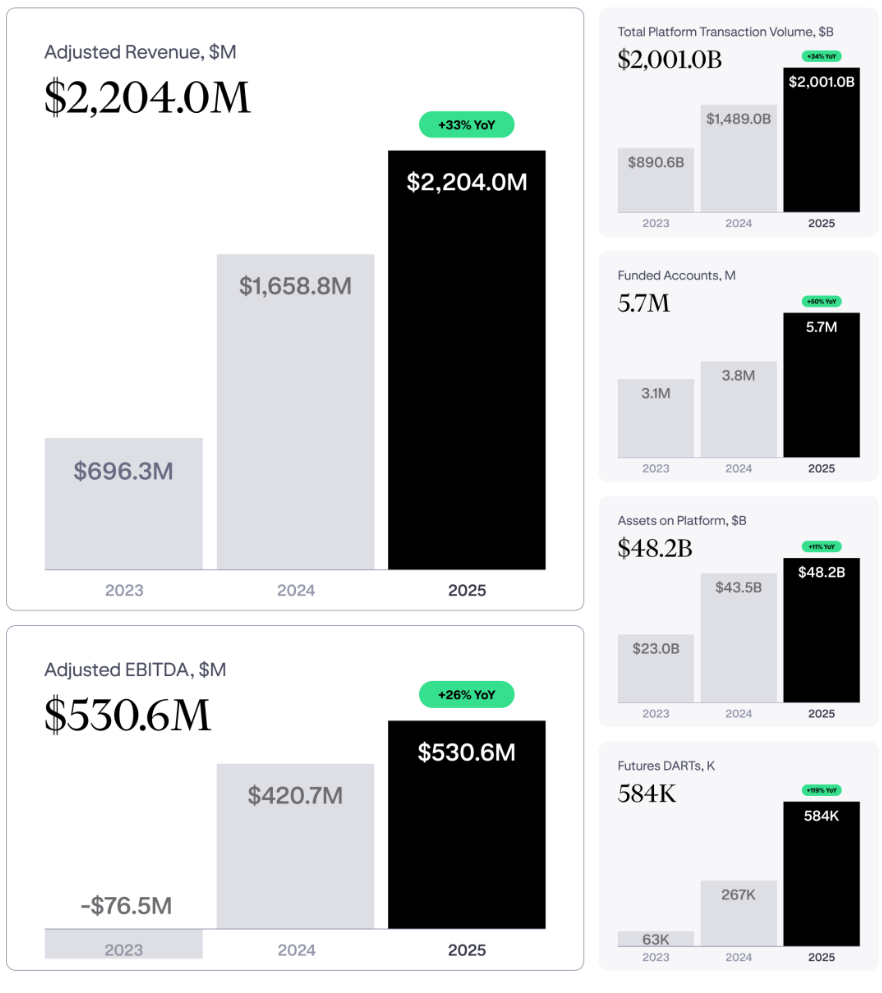

Adjusted revenue for the year reached $2.2 billion, with total transaction volume climbing 34% to $2 trillion. Nearly half of total revenue came from trading activity, while the remainder was generated through non-trading services such as custody solutions, payments, and financing products. Adjusted EBITDA rose to $531 million, reflecting a margin of 26% and highlighting improved operational efficiency.

By year-end, assets held on the platform totaled $48.5 billion, representing a 12% increase. Funded customer accounts grew by 50% to 5.7 million, supported by organic user growth and the integration of newly acquired platforms.

Multibrand Corporate Structure

During the year, Payward adopted a multibrand corporate structure designed to separate consumer-facing products from its infrastructure operations. This model allows the company to scale innovation while maintaining risk management and regulatory oversight. The structure also consolidates multiple acquisitions under a unified framework, including platforms focused on trading, derivatives, and tokenized financial products.

The company noted that acquisitions played a key role in boosting futures trading activity, with daily average revenue trades more than doubling. The revised structure positions Payward to expand globally while supporting diverse revenue streams beyond spot trading.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.