The Canadian government has imposed a C$19.5 million ($14.1 million) fine on global crypto exchange KuCoin, citing violations of the country’s anti-money laundering (AML) and terrorist financing laws. KuCoin, however, is pushing back, filing an appeal in the Federal Court of Canada and calling the penalty “excessive and punitive.”

FINTRAC’s Findings

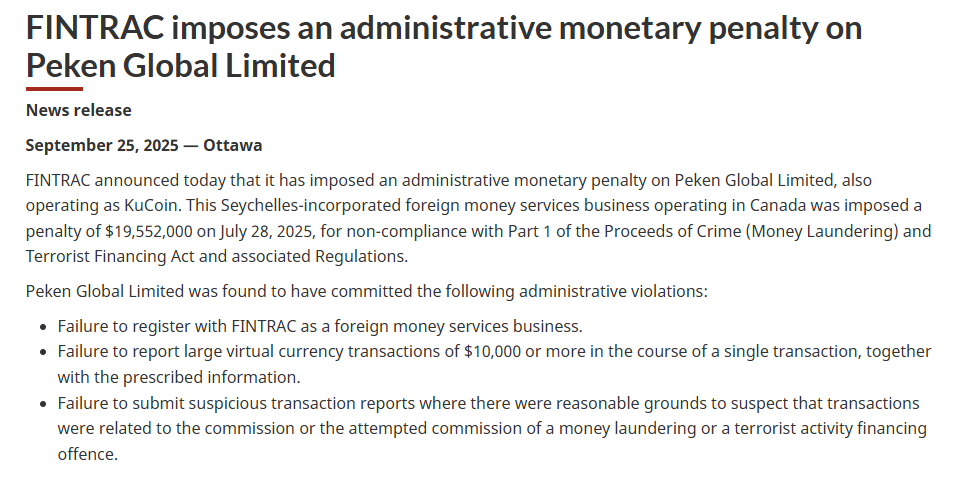

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) announced on Sept. 26 that it had issued the administrative penalty against Peken Global Ltd., KuCoin’s operating entity. Regulators alleged that the exchange:

- Failed to register in Canada as a foreign money services business.

- Neglected to report large transactions over C$10,000 in cryptocurrency.

- Did not file suspicious activity reports tied to potentially unlawful transfers.

According to FINTRAC, these violations represent serious lapses in KuCoin’s Canadian operations and undermine efforts to monitor illicit financial activity within the crypto space.

KuCoin Pushes Back

In response, KuCoin stressed its commitment to transparency and compliance but firmly rejected FINTRAC’s interpretation of its activities.

“We disagree with this decision on both substantive and procedural grounds, and we have pursued legal avenues by submitting an appeal before the Federal Court of Canada to ensure a fair outcome for KuCoin,” CEO BC Wong stated on X.

The exchange argues that FINTRAC’s classification of KuCoin as a foreign money services business is not accurate and disputes the regulator’s methodology in calculating the penalty.

Market Impact and Exchange Performance

News of the fine and appeal had a modest impact on KuCoin Token (KCS), which slipped 0.7% to $15.12 in the past 24 hours, giving it a market capitalization of $1.9 billion.

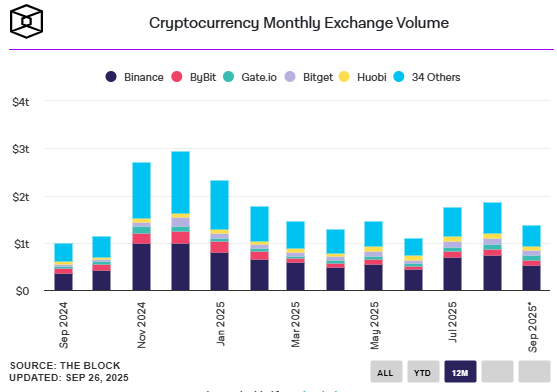

Despite regulatory challenges, KuCoin continues to be a significant player in global trading volume. In August 2025, the platform processed $53.6 billion in transactions, an increase from July’s $49.9 billion. However, KuCoin still trails far behind larger competitors—Binance led with $737.1 billion in volume, while Bybit recorded $126.5 billion in the same period.

Why This Matters for the Crypto Industry

The case highlights growing regulatory pressure on crypto exchanges operating in Canada and beyond. The fine against KuCoin reflects a broader trend where financial authorities are tightening enforcement of AML and counter-terrorist financing (CTF) standards.

If KuCoin’s appeal is unsuccessful, the decision could set a precedent for how foreign-based exchanges are regulated in Canada. It could also accelerate the push for stricter oversight of crypto platforms that serve Canadian customers without local registration.

KuCoin’s $14.1 million penalty underscores the rising compliance risks for global exchanges, especially as countries like Canada strengthen regulatory frameworks. The outcome of KuCoin’s appeal will be closely watched by the industry, as it could define how aggressively regulators enforce cross-border crypto operations moving forward.

For now, KuCoin remains firm in its stance: committed to compliance, but unwilling to accept what it views as an unfair regulatory judgment.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.