KULR Technology Group, a leader in thermal management solutions for energy storage systems, has deepened its commitment to Bitcoin by acquiring an additional 90 BTC for approximately $10 million, bringing its total holdings to 1,021 BTC. This move officially places the company among a select group of public firms with more than 1,000 bitcoins on their balance sheets.

Strategic Expansion of Bitcoin Treasury

The latest purchase was disclosed in an SEC 8-K filing, with KULR reporting an average acquisition price of $108,884 per BTC, inclusive of all fees. The company’s total investment in Bitcoin now stands at around $101 million, with a current market value of $113 million, reflecting paper gains of roughly $12 million.

This expansion is part of a broader Bitcoin treasury strategy first announced in December. The approach combines the use of surplus operational cash, a $20 million credit facility with Coinbase Credit, Inc., and KULR’s $300 million at-the-market equity program to fund digital asset acquisitions.

Funding Through Coinbase Credit Facility

To support its recent Bitcoin purchase, KULR borrowed $8 million from Coinbase’s institutional lending arm on July 8. The loan carries an 8% fee and is secured by 166 BTC, covering 156.25% of the loan’s principal. This arrangement demonstrates KULR’s risk-managed use of credit to expand its Bitcoin holdings while maintaining strong asset backing.

Ranking Among Top Bitcoin-Holding Public Companies

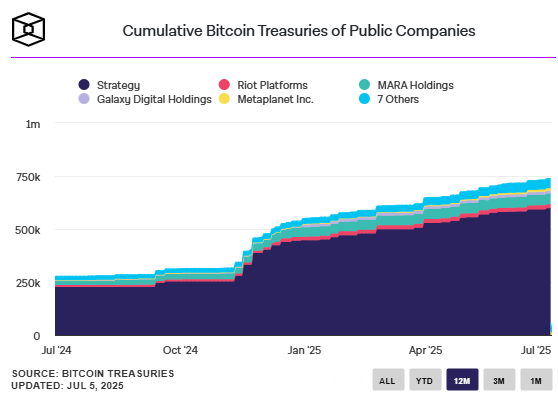

By crossing the 1,000 BTC threshold, KULR now ranks 31st out of 138 public firms with active Bitcoin strategies, according to Bitcoin Treasuries data. This places it in the company of notable corporate Bitcoin holders such as Semler Scientific and Metaplanet.

The firm also reports a BTC Yield of 291.2% year-to-date, a performance metric that compares Bitcoin holdings against diluted share counts over time. This yield is used internally to assess how effectively the strategy drives shareholder value growth.

Long-Term Vision Amid Market Fluctuations

Despite a 5.7% decline in stock price on Wednesday, KULR’s decision to accumulate more Bitcoin underscores its belief in the asset as a long-term store of value and strategic financial hedge. The company is positioning itself at the intersection of clean energy innovation and digital asset finance, signaling a progressive shift in treasury management.

With Bitcoin adoption growing among public companies, KULR’s proactive approach may serve as a blueprint for firms looking to align capital preservation strategies with exposure to emerging technologies.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.