Linqto, a U.S.-based private equity investment platform known for offering early access to pre-IPO companies, has filed for Chapter 11 bankruptcy, citing legal and structural compliance issues. The company owns 4.7 million Ripple shares, but now faces regulatory scrutiny and federal investigations over past practices.

Bankruptcy Filing Follows SEC Compliance Allegations

Filed with the U.S. District Court for the Southern District of Texas, the Chapter 11 petition comes amid mounting legal pressure and reported internal misconduct. Linqto’s new management claims the platform may have violated U.S. securities laws, with an internal review uncovering disturbing evidence.

“Linqto customers never owned the securities they thought they did,” an internal memo revealed, according to a Wall Street Journal report.

Linqto allegedly offered private company shares—including Ripple equity—to users ineligible under accredited investor standards, and at significant markups beyond legal limits. Reports suggest Ripple shares were marketed at 60% above the cost price, violating SEC rules limiting markups to 10%.

Ripple Clarifies No Business Ties With Linqto

Ripple CEO Brad Garlinghouse confirmed that while Linqto is a shareholder, “Ripple has never had a business relationship with Linqto, nor participated in its funding rounds.” The clarification distances Ripple from Linqto’s operations and potential liabilities.

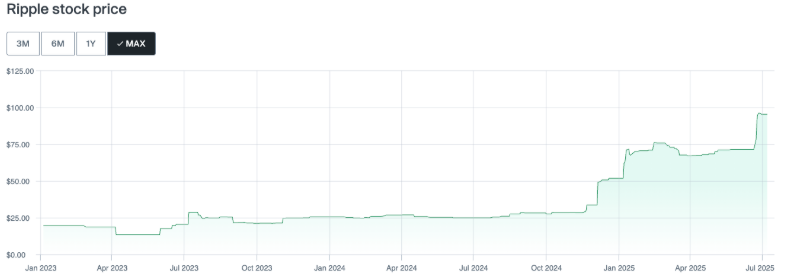

Based on Forge secondary market data, Linqto’s Ripple holdings are estimated around $450 million, though filings indicate broader exposure of over $500 million across 111 private companies.

Federal Investigations and Securities Law Violations

The SEC is reportedly investigating Linqto’s improper structuring of investment vehicles. Its “Liquidshares” entities allegedly lacked transfer approvals from companies like Ripple, raising further legal concerns. The firm’s marketing tactics, investor eligibility processes, and valuation practices are also under review.

“These aren’t minor compliance errors — they represent systemic misconduct,” said Linqto’s new CEO, Dan Siciliano.

First Hearing Set in Restructuring Process

The initial bankruptcy hearing is scheduled for Tuesday at 9:00 PM UTC. Witnesses include Linqto’s Chief Restructuring Officer Jeffrey Stein, debt advisors from Jefferies, and representatives from corporate restructuring firm Epiq.

Linqto’s downfall highlights the growing regulatory pressure on private investment platforms dealing with crypto-related assets. As U.S. authorities crack down on unlicensed securities offerings and investor protections, transparency and legal compliance are becoming non-negotiable for fintech players.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.