LTC Climbs 2.1%, Testing Resistance as Global Uncertainty Shapes Market Sentiment

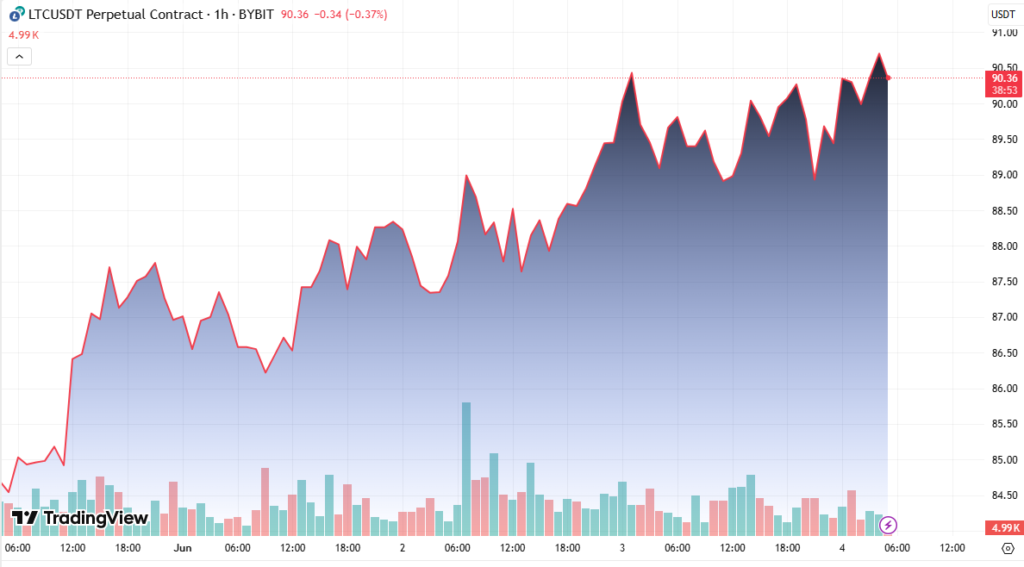

Litecoin (LTC) rose 2.1% in the last 24 hours, briefly surpassing the critical $90 resistance level, as global markets react to evolving macroeconomic signals. The surge marked a notable move for the altcoin, which has been consolidating in a tight range amid low volatility across major cryptocurrencies.

Breaks Psychological $90 Level

LTC touched a session high of $90.46, breaking past the psychologically important $90 barrier before retreating slightly to end the session around $89.32. The breakout came during early trading hours and was fueled by higher lows on the chart, indicating sustained bullish pressure.

Despite a brief selloff near $89.20, bulls quickly regained control, establishing $87.90 as a key support zone. Analysts observed a double-top formation near $89.60, followed by a consolidation phase suggesting traders are weighing next moves.

Macro Backdrop Boosts Risk Appetite

Litecoin’s rally reflects growing interest in risk-on assets, following fresh tariff announcements by President Trump that unsettled broader markets. While traditional investors turned cautious, crypto markets responded with increased activity, particularly in altcoins like LTC.

Meanwhile, in Europe, inflation dipped below the European Central Bank’s (ECB) 2% target, prompting speculation about a possible interest rate cut in the coming months. That shift could further boost appetite for crypto assets as investors seek alternatives to fiat-based instruments with declining yields.

Technical Setup Hints at Continuation

From a technical standpoint, Litecoin’s recent breakout is supported by volume activity and a bullish price structure. The current setup features:

- Key support at $87.90

- Double top resistance at $89.60

- Psychological resistance at $90, now under threat of being flipped into support

The consolidation near $89.32 shows that traders are digesting gains, with volatility likely to resume if either support fails or the $90 mark is cleared decisively.

Outlook: Bulls Eye Breakout Continuation

If support levels hold firm and macro tailwinds persist, LTC may retest and sustain levels above $90, potentially targeting the next resistance near $92.50. A clean breakout above $90 with volume confirmation would validate a bullish continuation pattern and could attract short-term momentum traders.

For now, the market appears cautiously optimistic, with Litecoin at a technical crossroads in a fundamentally uncertain world.