MARA Holdings, the world’s largest Bitcoin mining company—formerly known as Marathon Digital Holdings—has achieved a new all-time high in annualized Bitcoin mining revenue, surpassing $752 million as of May 27. The surge comes on the heels of Bitcoin’s price rally, which recently crossed $112,000 for the first time in history.

Bitcoin Rally Sparks Mining Boom

According to data from CryptoQuant, MARA recorded its highest-ever revenue day, capitalizing on Bitcoin’s rapid price appreciation. “Quarterly reports are slow. Onchain shows revenue in real time,” wrote CryptoQuant CEO Ki Young Ju in a May 27 post on X, highlighting the real-time nature of blockchain analytics.

The price jump in BTC is partly attributed to economic turbulence in Japan, where rising bond yields have pushed investors toward inflation-hedging assets like Bitcoin. This macroeconomic shift has contributed to heightened institutional interest and increased network activity.

MARA Leads Public Bitcoin Miners

With a market capitalization of $5.18 billion, MARA stands as the largest publicly traded Bitcoin mining firm, according to Companiesmarketcap. The firm has rapidly expanded its hash rate capacity over the past year, solidifying its leadership in the crypto mining sector.

Even after the Bitcoin halving, which cut mining rewards by 50%, MARA’s operations remain profitable due to scale, efficiency, and the rising value of BTC. This positions the company for sustained dominance in a post-halving landscape.

MARA’s Bitcoin Holdings Cross $5.28 Billion

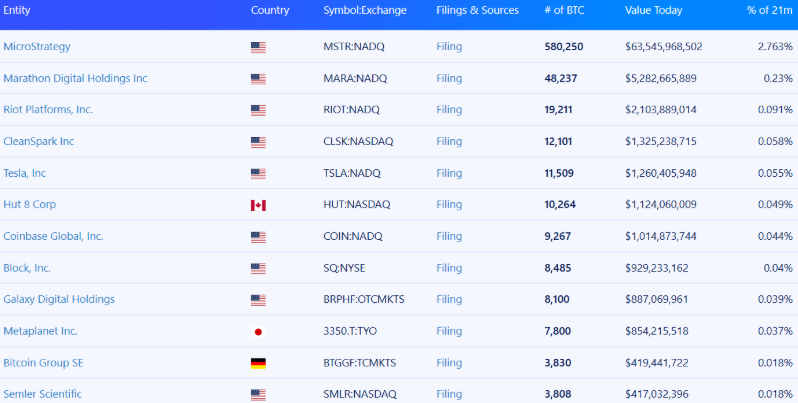

As of May 27, MARA holds 48,237 BTC, valued at over $5.28 billion, according to Bitbo data. This makes the company the second-largest corporate holder of Bitcoin, commanding over 0.23% of the total BTC supply.

MARA’s continued accumulation reflects its long-term bullish outlook on Bitcoin and a strategy to hold mined coins rather than sell during market highs.

What’s Next for MARA?

As Bitcoin’s price trajectory remains bullish, MARA is expected to further enhance its mining infrastructure and possibly expand globally. Investors are closely watching the firm’s next earnings report, which could reflect the financial impact of these record-setting revenue levels.