The crypto industry is heading toward a period of major consolidation, with many smaller firms likely to be acquired or forced to merge as market conditions tighten. Industry executives say the current downturn is exposing structural weaknesses across the sector, particularly among companies that lack sustainable business models.

Crypto Market Decline Acts as Catalyst

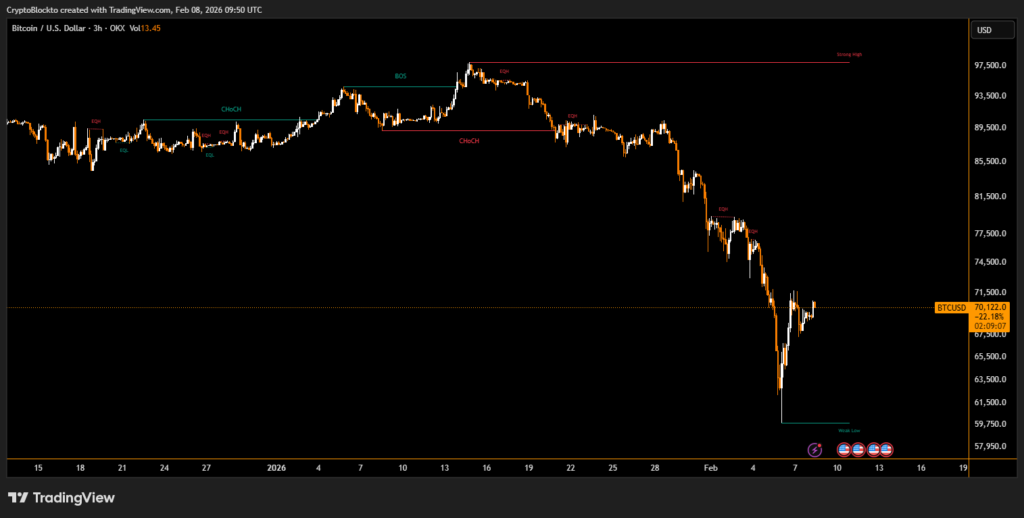

The recent market correction is expected to accelerate this shift. Bitcoin has fallen nearly 45% from its October peak of $126,100 and is trading near $69,400. This sharp decline has reduced speculative valuations and placed pressure on companies that were built during periods of easy capital and rapid growth. As prices fall, access to funding has become more selective, forcing firms to reassess their long-term viability.

From High Valuations to Realistic Pricing

Many crypto companies delayed consolidation during previous market cycles, buoyed by inflated valuations and expectations of a rapid rebound. Some firms with limited revenue growth continued to seek acquisition prices far disconnected from fundamentals. That dynamic is now changing as buyers become more disciplined and sellers adjust expectations to current market realities.

Farley said that the industry’s consolidation should have happened earlier, but inflated valuations kept false optimism going. “It should have happened a year or two ago,” he said.

Fewer Businesses, More Products

Executives argue that a key realization is emerging: not all crypto ventures are full-fledged businesses. Many are standalone products that require scale, broader infrastructure, or integration into larger platforms to survive. As a result, mergers and acquisitions are likely to increase, leading to a less fragmented but more resilient industry.

While consolidation may strengthen leading firms, it could also result in layoffs and project closures. However, investors believe this phase is a natural step in the maturation of the crypto market, similar to consolidation cycles seen in other technology sectors.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.