Shiba Inu (SHIB), one of the most popular meme coins in the crypto market, is flashing a rare and potentially bearish technical signal. For the first time in its trading history on major exchanges, SHIB is on the verge of forming a Death Cross on the weekly chart—a development that could significantly impact investor sentiment and price action.

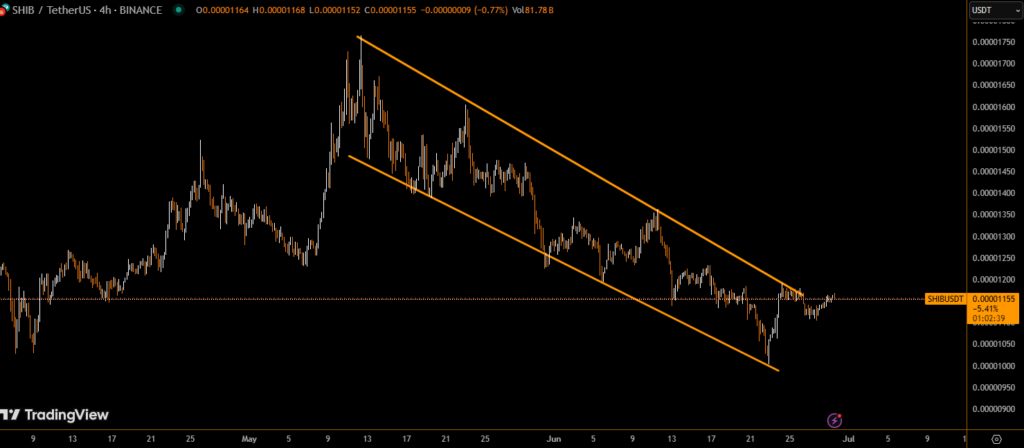

Shib H4 price chart

What Is a Death Cross and Why It Matters for SHIB

A Death Cross occurs when the 50-day moving average (MA) crosses below the 200-day MA, a pattern that typically signals a long-term downtrend. While these formations are more commonly observed on daily charts, the fact that it’s appearing on the weekly timeframe for SHIB gives this signal extra weight.

“Weekly Death Crosses are rare but powerful indicators, especially for assets like SHIB that rely heavily on community-driven momentum.”

Unlike in 2021 or early 2022 when Shiba Inu traded on hype cycles, this technical setup reflects prolonged weakness following SHIB’s full cycle peak and gradual decline through most of 2025.

Price Struggles Below Resistance, Testing Support

Currently, SHIB is trading around $0.00001162, bouncing slightly from a critical support zone at $0.00001. Despite the minor rebound, the price structure remains heavily bearish, and momentum indicators are showing fatigue.

What’s more concerning is the distance between SHIB’s current price and its major moving averages. Both the 50-day and 200-day MAs are acting as formidable resistance, with no recent attempts to even test those levels. This creates a technical ceiling that limits upside potential unless significant buying interest returns.

Market Sentiment Cautious Amid Supply Cuts and Volatility

Adding complexity to SHIB’s outlook is the recent burn of over 1.3 billion tokens, aimed at reducing supply and potentially increasing long-term value. However, the broader market sentiment remains cautious.

The looming Death Cross has led many traders to question SHIB’s near-term viability:

- Will it hold the $0.00001 level, or break down toward deeper support?

- Can whale accumulation or utility upgrades shift sentiment?

- Or will the technical weakness trigger a larger selloff?

What Traders Should Watch Next

For now, the key level to watch is the confirmation of the Death Cross. If the 50-week MA officially crosses below the 200-week MA, this could attract more bearish pressure, especially from algorithmic or institutional traders who rely on trend signals.

On the flip side, if SHIB reclaims the $0.000013–$0.000015 region, it could neutralize the signal and attract short-covering or fresh retail interest. But without clear catalysts or increased demand, that recovery remains speculative.

Conclusion: Prepare for Volatility

Shiba Inu is facing a make-or-break moment. The technicals point toward weakness, and the looming weekly Death Cross is a strong signal for caution. Whether this leads to a deeper correction or becomes a contrarian buy signal will depend on how SHIB reacts in the coming days.

For investors and traders, this is a time to closely monitor price action, manage risk, and avoid emotional decisions driven solely by hype.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.