Metaplanet has revised its financial outlook upward for 2025 and 2026, projecting strong revenue growth driven by its expanding Bitcoin-focused operations. The improved guidance comes even as the company prepares to report a non cash Bitcoin impairment exceeding $670 million, reflecting year-end market valuations rather than operational weakness.

Revised 2025 Financial Guidance

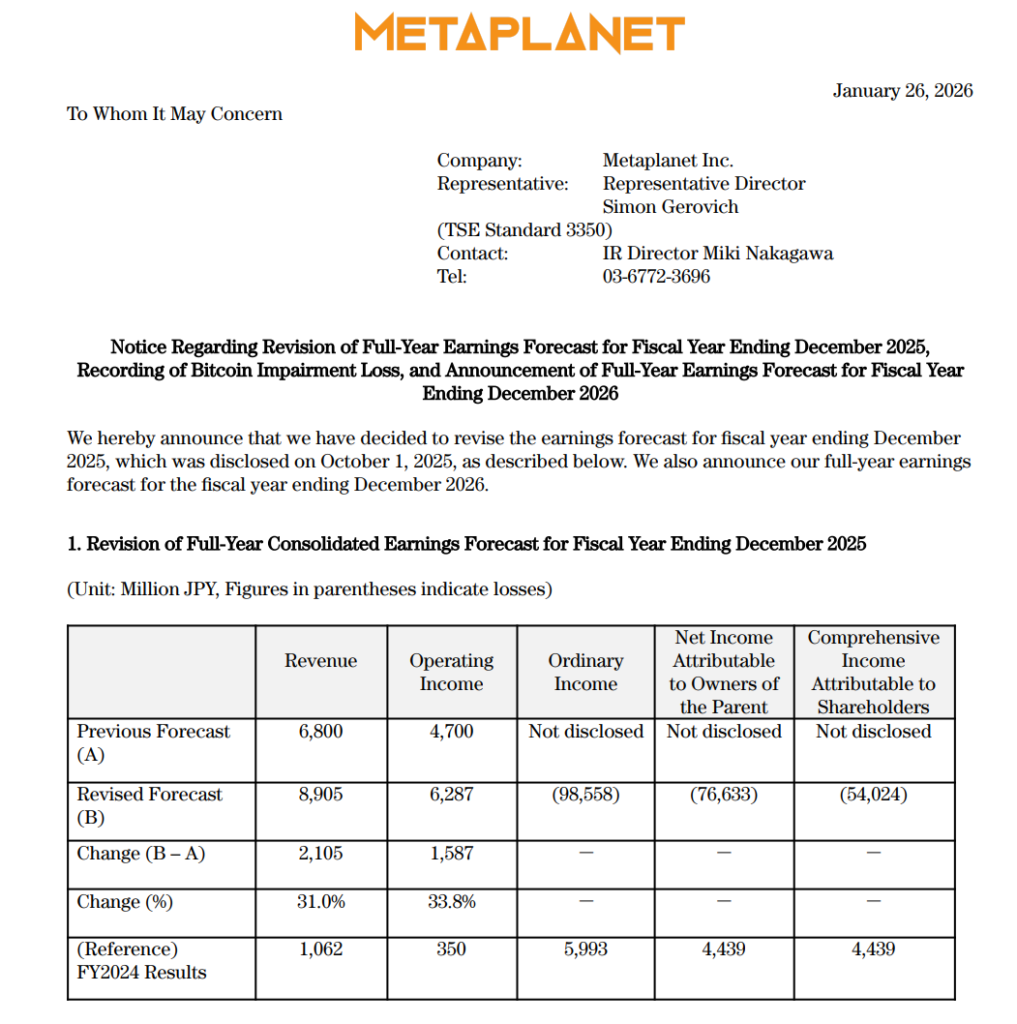

Metaplanet now expects 2025 revenue of approximately $58 million, with operating income forecast near $40 million. However due to Bitcoin price fluctuations at the end of the reporting period, the company anticipates an ordinary loss of more than $630 million and a net loss approaching $500 million. These losses are largely attributed to mark-to-market accounting adjustments on its Bitcoin holdings.

Bitcoin Income and Treasury Growth

Revenue from the company’s Bitcoin Income Generation business significantly outperformed earlier expectations, reaching an estimated _ $55 million for 2025_. Meanwhile, Metaplanet’s Bitcoin treasury expanded rapidly, with holdings increasing from 1,762 BTC to over 35,000 BTC during the year. The firm reported a 568% increase in Bitcoin yield per diluted share, highlighting aggressive balance sheet expansion.

Looking ahead Metaplanet forecasts 2026 revenue of roughly $103 million and operating income of about $73 million , with the majority expected to come from Bitcoin-based income strategies. Due to Bitcoin’s volatility, the company has not issued net income projections for 2026, underscoring ongoing market risk despite strong operational momentum.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.