Metaplanet, a Tokyo-listed firm known for its aggressive Bitcoin accumulation strategy, has expanded its crypto treasury with the purchase of 463 BTC worth $53.7 million. The acquisition cements its position as one of the top corporate holders of Bitcoin globally, maintaining 7th place with a total of 17,595 BTC.

Average Buy Price Tops $115,000

The company acquired the latest tranche at an average price of $115,895 per BTC, bringing its total Bitcoin cost basis to $1.78 billion. The average price per coin now stands at $101,422, according to CEO Simon Gerovich.

This move reflects Metaplanet’s long-term strategy to anchor its financial model around Bitcoin, aligning its capital structure with crypto-centric values.

$3.7 Billion Capital Raise Plan Backing the Strategy

Just before the latest BTC purchase, Metaplanet filed to raise up to 555 billion yen ($3.7 billion) through perpetual preferred shares—a funding method designed to fuel ongoing Bitcoin purchases without diluting common shareholders.

CEO Gerovich explained:

“On a Bitcoin standard, the mission is to continuously grow Bitcoin per share. Issuing perpetual preferreds is a highly accretive tool designed to maximize long-term shareholder value.”

This strategy suggests Metaplanet is not just investing in Bitcoin but shifting toward a Bitcoin-native treasury model.

Global Ranking and Market Reaction

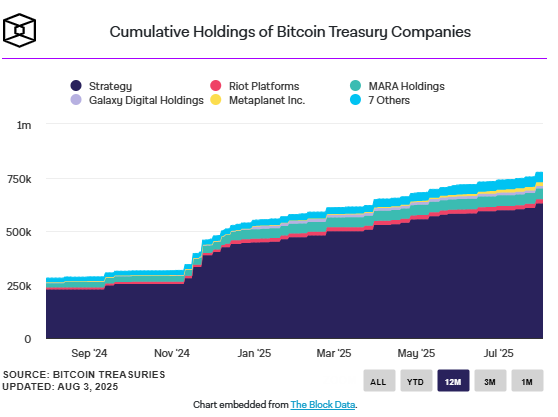

With its 17,595 BTC, Metaplanet remains the 7th-largest corporate Bitcoin holder worldwide, behind well-known names such as MicroStrategy, MARA, and Trump Media.

Despite the bullish move, Metaplanet’s stock declined 4.7% by midday Monday on the Tokyo Stock Exchange, likely reflecting market caution or profit-taking.

Bitcoin Price Recovery in Progress

At the time of Metaplanet’s announcement, Bitcoin traded at $114,645, up 0.8% in the past 24 hours, slightly rebounding from a weekend dip.

The acquisition highlights how corporate accumulation remains a powerful demand driver, especially during periods of price consolidation.

The Bigger Picture

Metaplanet’s strategy shows growing corporate confidence in Bitcoin as a long-term store of value. With billions committed and a clear capital-raising framework in place, it signals that Bitcoin treasury adoption is expanding beyond U.S. firms—reaching Asia’s capital markets with increasing conviction.

Ask ChatGPT

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.