Tokyo listed firm Metaplanet has moved to address mounting online criticism over its bitcoin acquisition strategy and financial disclosures. CEO Simon Gerovich publicly defended the company’s record, rejecting allegations that it concealed high-cost bitcoin purchases or failed to disclose borrowing details properly.

Gerovich stated that all company bitcoin wallet addresses are accessible through a live dashboard available to shareholders, arguing that claims of non transparency are “factually incorrect.” He acknowledged that certain loan details, including lender identities and exact interest rates, were withheld at the request of counterparties for confidentiality reasons.

Bitcoin Accumulation Strategy Faces Market Pressure

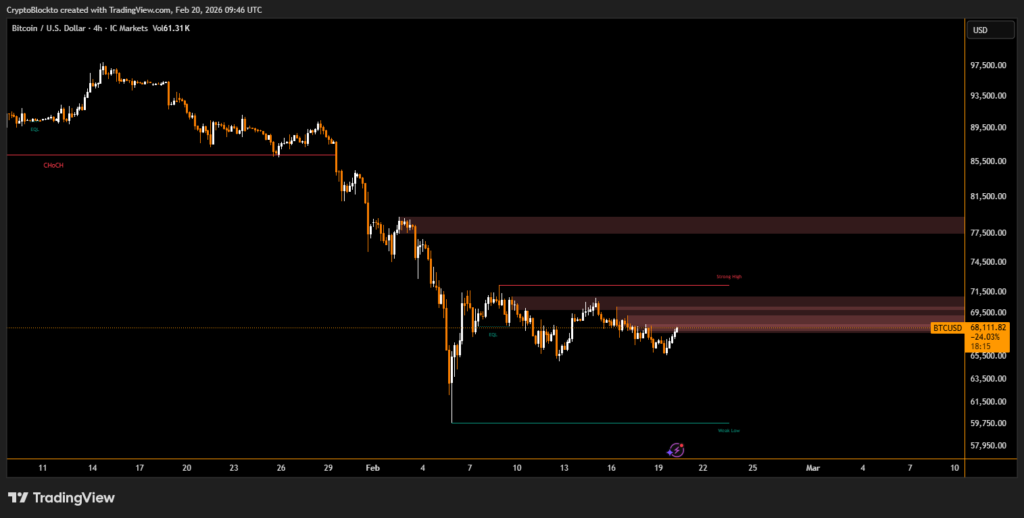

Metaplanet’s strategy centers on long term bitcoin accumulation rather than short term price timing. The company increased purchases around September 2025, when Bitcoin traded near $114,000. Since then, bitcoin has declined more than 40%, recently hovering near $68k.

The downturn contributed to a reported net loss of 95 billion yen ($619 million) for 2025, largely driven by unrealized valuation losses on bitcoin holdings. However, operating profit surged 1,695% year over year to 6.29 billion yen ($41 million).

Stock Performance Compared to Bitcoin

Gerovich argued the firm has not underperformed bitcoin during the correction. He noted the company’s shares declined 23% during the same period bitcoin fell 24%. Despite a six month share price drop exceeding 60%, Metaplanet continues pursuing its goal of accumulating 210,000 BTC by 2027 through operating cash flow and capital raises.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.