Metaplanet Aims to Acquire 210,000 BTC by 2027

Japanese investment firm Metaplanet has seen its shares surge after announcing an ambitious plan to purchase 210,000 Bitcoin by the end of 2027. If successful, this would make the company the second-largest holder of Bitcoin among public companies—behind only Michael Saylor’s Strategy.

The plan involves raising $5.4 billion, and Metaplanet updated this goal through a stock acquisition rights program disclosed on June 6. This move significantly increases their previous goal of 21,000 BTC.

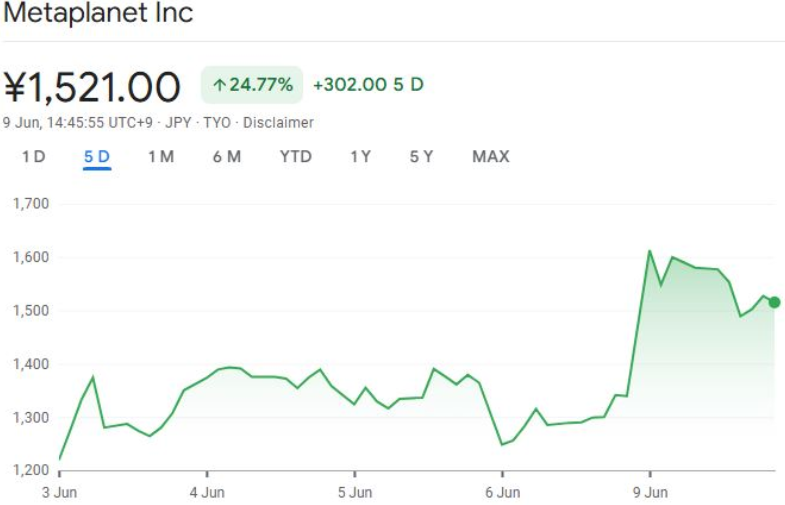

Shares Jump Over 20% Following Announcement

Following the announcement, Metaplanet’s stock (3350T) opened higher on June 9, climbing over 12% to trade at 1,505 yen ($10.42). The stock reached an intraday high of 1,641 yen ($11.36), marking a 22% gain.

Metaplanet currently holds 8,888 BTC, following its latest purchase of 1,088 Bitcoin on June 2. The company has also unveiled a “555 million” plan—aiming to hold 100,000 BTC by 2026, and purchase the remaining 110,000 BTC by 2027.

Bitcoin Holdings Surge Among Public Firms

Since Metaplanet’s first Bitcoin buy in July 2024, its stock has increased by over 1,744%. This growth reflects the rising popularity of corporate Bitcoin reserve strategies.

According to Bitbo data, public companies now hold over 3 million BTC, with a combined value of more than $342 billion. This represents 3.2% of all Bitcoin that will ever exist, based on recent figures from Standard Chartered.

Stock Reactions Vary Across Bitcoin-Buying Firms

Metaplanet is not alone. Other firms have also seen stock price spikes following Bitcoin purchases:

- Blockchain Group (France): Shares soared 225% after its BTC buy in November 2024.

- DigiAsia Corp (Indonesia): Stock surged 91% after announcing its first BTC funding round.

- GameStop: Shares rose 12% in March but dropped 11% in May after executing its 4,710 BTC purchase.

However, not all companies see positive reactions. Norwegian brokerage K33 saw its stock dip 1.96% despite announcing a Bitcoin acquisition strategy in May.

Conclusion

Metaplanet’s bold move to acquire 210,000 BTC by 2027 signals growing institutional confidence in Bitcoin. As more companies adopt similar strategies, investor interest in corporate Bitcoin holdings continues to expand, though market reactions remain mixed.