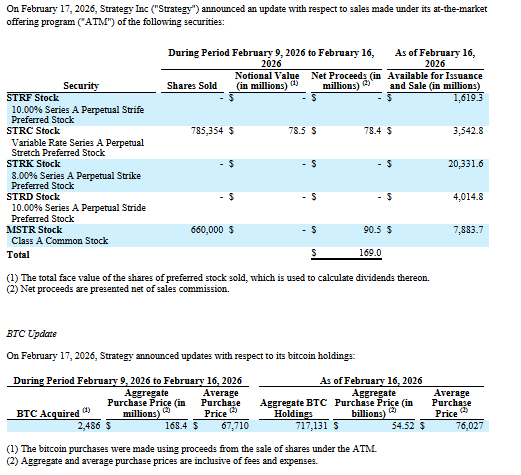

Strategy has purchased 2,486 additional BTC for roughly $168.4 million, bringing its total holdings to 717,131 bitcoins. The acquisitions made between February 9 and 16 at an average price of $67,710 per bitcoin, were funded through the sale of the company’s Class A common stock (MSTR) and perpetual preferred stock (STRC).

Strategy’s total investment in bitcoin now stands at approximately $54.5 billion, with an average cost of $76,027 per bitcoin. While this represents over 3.4% of Bitcoin’s 21 million hard cap, the firm’s current mark-to-market losses are around $5.7 billion.

Funding Through Stock Issuances and Preferred Equity

The recent purchases were financed using proceeds from at-the-market sales, including 660,000 MSTR shares raising $90.5 million and 785,354 STRC shares raising $78.4 million. Strategy maintains substantial remaining capacity under its equity programs, allowing continued acquisitions under its “42/42” plan, targeting $84 billion in capital raises through 2027 for future bitcoin purchases.

Risk Management and Market Position

Despite recent mark-to-market losses, Strategy asserts it can withstand bitcoin price declines to $8,000 while covering all debts. Analysts note the firm’s conservative structure, relying on long-dated perpetual preferred equity and no major debt maturities until 2028, positions it well for potential market recovery. Saylor emphasize continued confidence in bitcoin’s long-term outperformance compared to traditional equities.

This acquisition highlights Strategy’s ongoing commitment to expanding its bitcoin treasury and maintaining a dominant market presence.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.