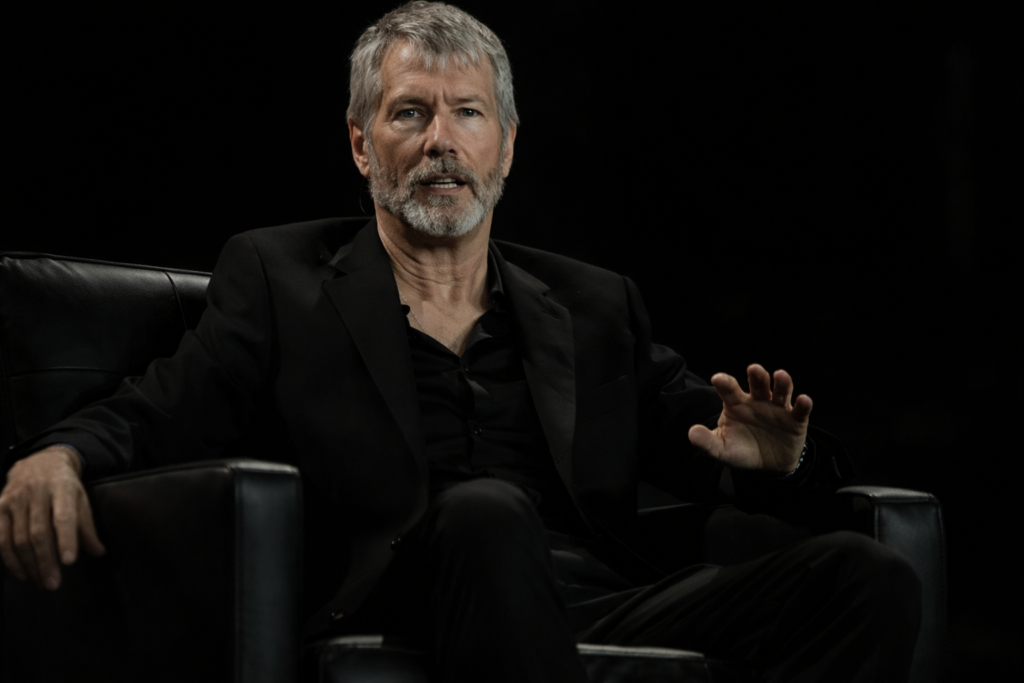

Strategy, the bitcoin-focused treasury firm led by Michael Saylor, made a modest addition to its bitcoin holdings just before last week’s broader crypto market downturn.

Strategy Bitcoin Purchase Details

The company acquired 1,142 bitcoin for approximately $90 million, paying an average price of $78,815 per coin. The purchases were funded through the issuance of common stock and were completed early in the week, prior to the sharp decline that later pushed bitcoin prices toward the $60,000 level.

Following the latest acquisition, Strategy now holds a total of 714,644 bitcoin. The firm’s cumulative investment stands at roughly $54.35 billion, translating to an average purchase price of $76,056 per bitcoin across its entire position.

Timing and Market Reaction

Based on the reported purchase price, the buying activity likely occurred on Monday or Tuesday, before market conditions deteriorated later in the week. Bitcoin subsequently retreated from near $70,000 to significantly lower levels during Thursday’s selloff.

Shares of Strategy declined nearly 4% in premarket trading as bitcoin pulled back from its recent highs, reflecting continued sensitivity of the stock to short-term price movements in the digital asset.

Despite near-term volatility, Strategy continues to position itself as a long-term bitcoin accumulator, maintaining one of the largest corporate bitcoin treasuries globally and reinforcing its commitment to bitcoin as a core reserve asset.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.