Analysts warn as much as $8.8 billion could exit passive funds if major index providers follow MSCI’s lead

MicroStrategy is confronting a pivotal moment as MSCI evaluates whether to remove the company from key global equity indices, a decision expected by mid-January. The review comes during a period of heightened scrutiny over the firm’s aggressive Bitcoin-accumulation strategy and mounting concerns among risk-averse investors.

According to people familiar with the matter, discussions between MicroStrategy and MSCI are ongoing, with the outcome likely to have significant implications for the company’s market standing. Analysts caution that a removal from indices such as MSCI USA or MSCI World could trigger forced selling from passive investment products, which collectively hold large exposure to the stock.

“If index providers reassess MicroStrategy’s classification, passive outflows could be substantial,”

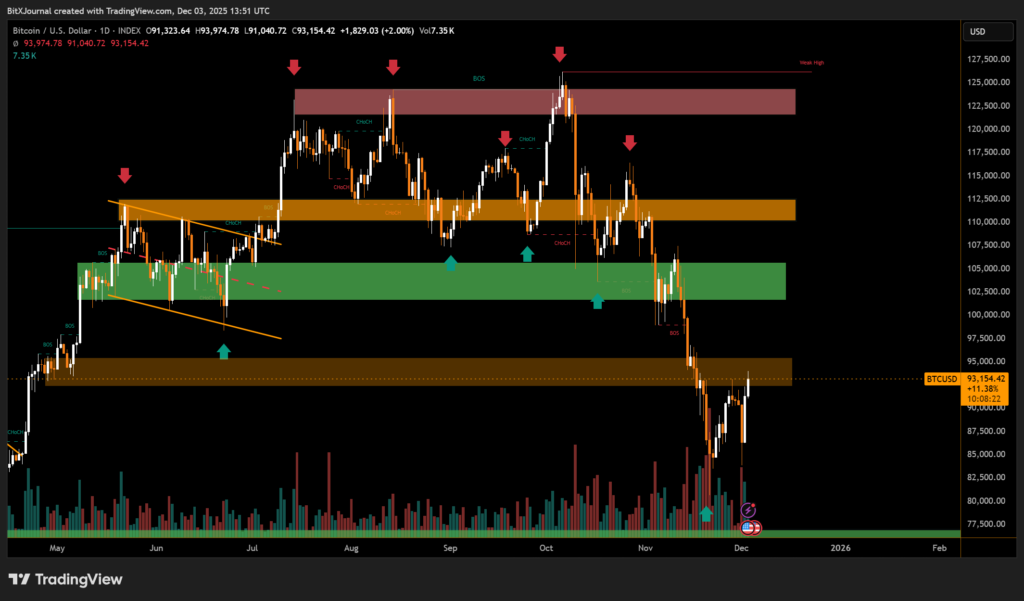

MicroStrategy’s market challenges have intensified in recent months. The company now holds approximately 650,000 Bitcoin on its balance sheet, a strategy funded through repeated debt and equity issuance. Critics argue that the approach exposes shareholders to amplified volatility—especially after Bitcoin’s sharp retreat from above $120,000 to recent lows near $82,000.

While Bitcoin has rebounded toward $93,000, the company’s stock remains down more than 35% year-to-date, reflecting investor unease over its leveraged Bitcoin-first model.

Executives maintain that they are cooperating with MSCI’s review. However, the possibility of losing index inclusion underscores growing questions about how MicroStrategy should be classified—and how sustainable its long-term strategy may be as market conditions tighten.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.