Analysts see the current Bitcoin cycle nearing a cooling phase as historical trends suggest a potential downturn ahead

Bitcoin enters ‘fall’ phase in its four-year market cycle

Morgan Stanley Wealth Management has signaled that Bitcoin’s market cycle is entering its “fall season”, a stage characterized by profit-taking before the next major downturn. In a recent episode of Crypto Goes Mainstream, Denny Galindo, investment strategist at the firm, compared Bitcoin’s cyclical behavior to the four seasons, noting a pattern of three years of growth followed by one year of decline.

“We are in the fall season right now,” Galindo said. “Fall is the time for harvest. It’s when investors should consider taking their gains — the question is how long this season will last before winter begins.”

The analogy reflects a growing recognition among Wall Street strategists that Bitcoin follows cyclical investment patterns similar to commodities and liquidity-driven macro markets.

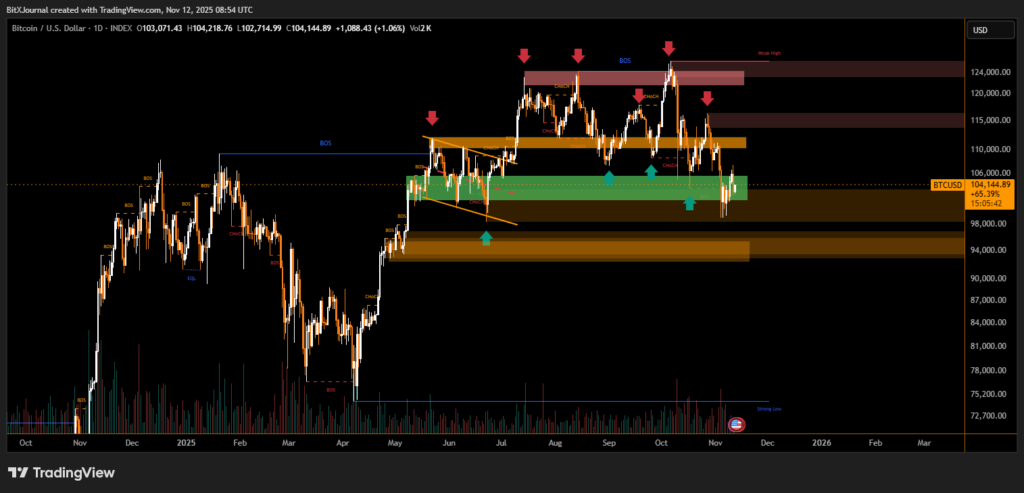

Market dip signals possible technical bear trend

On Nov. 5, Bitcoin (BTC) dropped below $99,000, breaching its 365-day moving average — a widely watched indicator of long-term momentum. According to Julio Moreno, head of research at CryptoQuant, this drop suggests a weakening market trend.

Analyst Andri Fauzan Adziima commented that the move “officially marked a technical bear market,” emphasizing that price action has started to mirror previous post-peak corrections.

Meanwhile, market-maker Wintermute reported that liquidity from stablecoins, ETFs, and digital asset treasuries — the three major sources of crypto capital — has reached a plateau. This stagnation could further contribute to a cooling phase in market momentum.

Institutions still see Bitcoin as a macro hedge

Despite the short-term caution, Morgan Stanley analysts noted that institutional interest in Bitcoin remains strong. Michael Cyprys, head of U.S. brokers and asset managers research, said that large investors increasingly view Bitcoin as “digital gold” and a hedge against inflation.

“Institutional investors are integrating Bitcoin into diversified portfolios,” Cyprys said. “Regulatory clarity and ETFs have significantly lowered barriers to entry.”

Recent data from SoSoValue shows U.S. spot Bitcoin ETFs holding over $137 billion in net assets, while Ether ETFs manage around $22.4 billion, underscoring the growing mainstream adoption of digital assets.

Cautious optimism amid cyclical transition

While Morgan Stanley’s “harvest” warning suggests a potential slowdown ahead, analysts emphasize that Bitcoin’s long-term narrative remains intact. With regulatory frameworks improving and institutional participation expanding, the asset’s next “winter” may be shorter — setting the stage for another growth cycle when “spring” arrives.

As Galindo concluded, investors should watch the cycles closely — because in Bitcoin’s seasonal rhythm, every fall is followed by a new beginning.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.