Nasdaq, the world’s second-largest stock exchange by market capitalization, has formally requested a rule change from the U.S. Securities and Exchange Commission (SEC) that would allow regulated exchanges in the United States to list and trade tokenized stocks.

If approved, this move could mark a turning point for the integration of blockchain technology into traditional financial markets, expanding investor access and boosting liquidity.

What Nasdaq Is Proposing

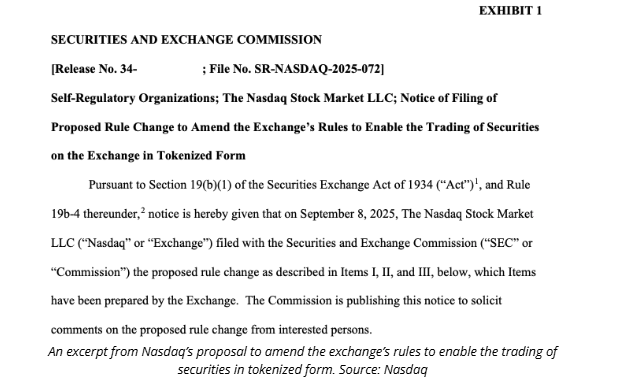

In its filing, Nasdaq asked the SEC to amend existing rules, including the definition of a security, to cover tokenized versions of stocks. The proposal states that these blockchain-based shares should be treated under the same execution and documentation rules as traditional securities, provided they are equivalent in rights and structure.

A key request is that tokenized assets must be clearly labeled, ensuring that all parties—including clearing and settlement entities like the Depository Trust Company (DTC)—can properly process transactions.

This clarity would help avoid confusion in the post-trade cycle, where blockchain-based versions of stocks may otherwise face settlement or reporting issues.

If the SEC approves Nasdaq’s request, U.S.-regulated exchanges would gain authorization to list tokenized shares. This could:

- Increase liquidity for blockchain-based securities.

- Expand access for investors interested in digital versions of traditional assets.

- Enhance settlement efficiency, potentially reducing delays and operational risks.

- Bring tokenized assets into mainstream finance, bridging the gap between Wall Street and blockchain technology.

Importantly, Nasdaq emphasized that tokenized assets would follow the same order execution priority as traditional stocks, ensuring fair treatment in trading.

Tokenization of real-world assets (RWAs) is a growing trend in finance, with banks, fintech firms, and crypto exchanges already experimenting with blockchain-based versions of equities, bonds, and funds.

Nasdaq’s proposal goes beyond a technical adjustment—it challenges the foundations of how securities are issued and settled in the U.S. By seeking official recognition, Nasdaq is aiming to legitimize tokenized stocks under federal securities law.

If approved, this move could accelerate the adoption of RWA tokenization and push other major exchanges to follow suit.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.