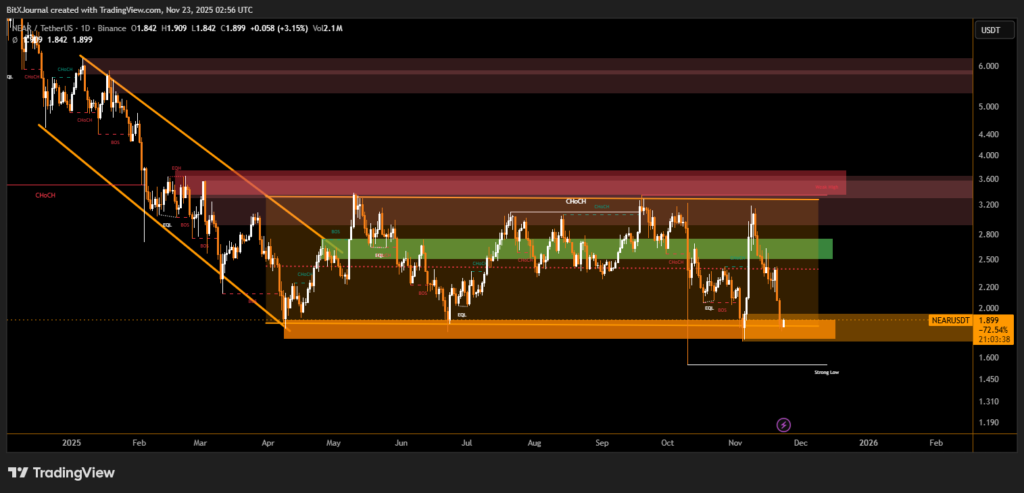

Market Structure Shows Prolonged Consolidation Turning Into Breakdown Risk as NEAR Trades Near Critical Demand Zone

NEAR is struggling to hold its footing after another rejection from the upper boundary of its multi-month consolidation range. The asset continues to hover around the $1.90 level, testing a broad demand zone that has repeatedly acted as a base throughout the year. While the broader crypto market remains under pressure, NEAR’s chart now signals a decisive moment, with traders watching whether buyers can defend the final major support before a potential deeper slide.

Technical Breakdown Points to Structural Weakness

The daily chart shows NEAR trapped in a long-standing range, repeatedly capped by resistance between $3.20 and $3.60, where multiple rejections highlight heavy supply. The lower boundary—from $1.80 to $2.00—has provided support several times, but each bounce has been weaker than the last.

This sustained loss of momentum reflects what analysts describe as a “compression pattern toward demand with weakening reaction strength.”

BitXJournal market technician noted that the repeated retests have “thinned out liquidity and signaled that the buy side is no longer absorbing with the same conviction as earlier in the year.”

The chart also highlights a series of bearish signals:

- A break of structure (BOS) after multiple failed attempts to reclaim mid-range levels.

- A consistent pattern of lower highs forming across September to November.

- Price sliding back into the major orange demand zone, where its current reaction will determine whether bulls can regain control.

Experts Warn of Possible Breakdown if Demand Weakens Further

If NEAR fails to defend the $1.80–$1.90 support, analysts caution that price could test lower inefficiency zones near $1.50, identified on the chart as a “strong low.”

According to one analyst, “A daily close below the lower boundary would mark a confirmed structural breakdown, shifting the narrative from consolidation to continuation of the broader downtrend.”

Still, some traders remain cautiously optimistic. BitXJournal research strategist argued that “this zone has historically triggered strong rebounds, and if broader market sentiment improves, NEAR could revisit $2.50–$2.80 in the short term.” The mid-range remains the first upside target should buyers step in.

NEAR now sits at a decisive technical level. The next few sessions will reveal whether buyers have enough strength left to protect the range or if the prolonged weakness will finally result in a breakdown. For now, the $1.80–$1.90 support remains the line separating consolidation from deeper correction.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.