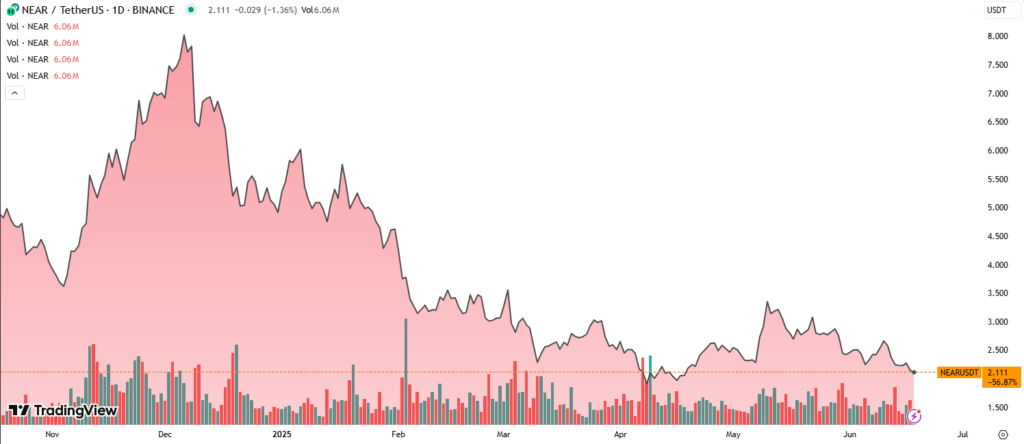

NEAR Protocol (NEAR) faced heavy selling pressure this week, plunging over 6% as rising tensions in the Middle East ripple through global markets. Despite short-term bearish sentiment, NEAR’s growing user base signals long-term strength.

Price Volatility as Geopolitical Risks Mount

The intensifying conflict between Iran and Israel has triggered a broader crypto market selloff, with NEAR showing notable sensitivity to global risk events.

NEAR-USD traded between $2.219 and $2.085, with resistance forming around $2.18–$2.22 during peak selling hours.

From 15:00 to 16:00, NEAR experienced high-volume selling, with trades totaling over 6.26M and 4.94M units, firmly establishing this resistance zone.

Strong Support Zone and Signs of Accumulation

Amid the downtrend, support emerged around $2.09–$2.10, where trading volume surged during the 10:00 hour, suggesting buyers may be stepping in at these levels.

Repeated tests of the $2.106–$2.108 zone, with increasing volume, hint at potential accumulation and the formation of a technical base.

By the final hour, NEAR traded between $2.09 and $2.12, consolidating and potentially forming a double-bottom reversal pattern, a signal of bearish exhaustion.

Technical Overview and Market Sentiment

Key technical observations:

- 6.1% price range from high to low within the day.

- Sell-off intensified between 12:37–12:39, dropping to $2.105.

- Bounce attempt to $2.112 formed during the last minutes of trading.

- Lower highs and a downward channel still dominate the broader trend.

Decreasing selling volume during consolidation suggests weakening bearish momentum, but confirmation of a trend reversal is still pending.

Long-Term Strength: 46 Million Active Users

While price action remains volatile, NEAR Protocol’s fundamental growth stands out. The network now reports over 46 million monthly active users, placing it among the most used blockchains globally.

This surge in real user adoption highlights NEAR’s growing utility, moving beyond speculation and aligning it with top-tier networks like Solana.

This strong user base could offer resilience in the face of market uncertainty and fuel future recoveries once macro conditions stabilize.

Conclusion

NEAR Protocol is currently under pressure from external geopolitical forces, with a 6% drop reinforcing short-term bearish signals. However, solid technical support and expanding user adoption may provide the foundation for a rebound in the coming sessions.

If accumulation holds and market tensions ease, NEAR could reclaim higher levels, particularly if the $2.10 support continues to attract buyers.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss