NEAR Shows Strength Amid Economic Uncertainty

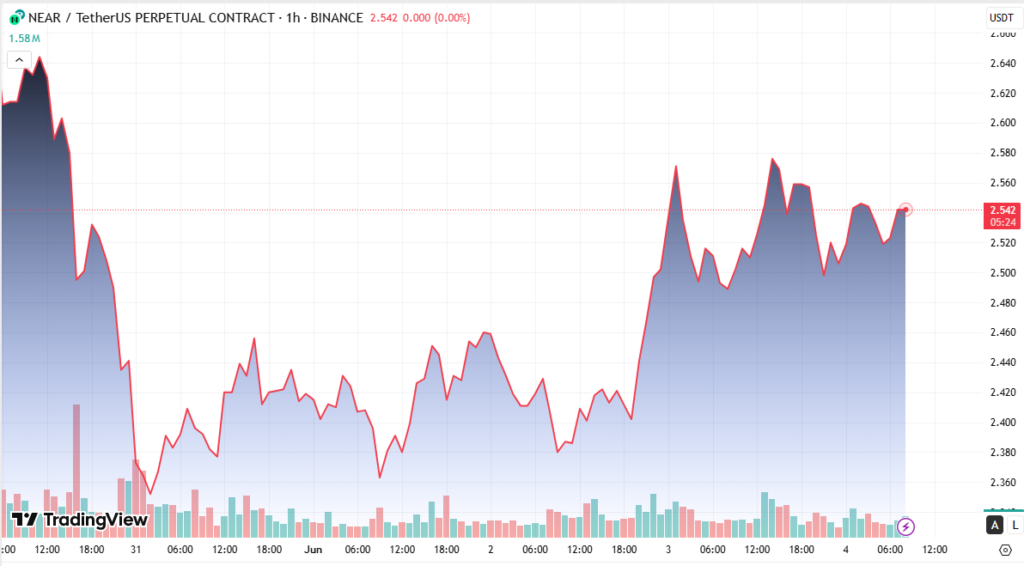

NEAR Protocol (NEAR) recorded a notable 4.60% price increase, rallying from $2.479 to $2.593 in the past 24 hours. The move comes as heightened US-China trade tensions and global macroeconomic shifts inject fresh volatility into both traditional and digital markets.

NEAR’s upward move reflects a strong technical breakout driven by high volume and a classic cup-and-handle chart pattern.

Global uncertainty, particularly related to tech-focused tariffs between economic giants, is reshaping investor behavior across asset classes. NEAR has benefited from a flight to alternative digital assets, fueled by speculation and technical momentum.

Global Economic Factors Influence Crypto Movements

The broader crypto market is reacting to escalating trade tensions, while the European Central Bank’s recent signals of rate cuts offer a partial counterbalance to investor anxiety.

NEAR’s price volatility mirrors macroeconomic stress, but its bullish structure points to investor confidence despite risk-off sentiment.

While central banks face a difficult mix of slowing growth and persistent inflation, traders are seeking hedges and new opportunities, with NEAR standing out among mid-cap altcoins.

Technical Analysis Signals Continued Bullish Outlook

NEAR’s price movement broke above key resistance at $2.53, supported by a volume surge exceeding 3 million units between 13:00 and 15:00. This confirmed strong buyer conviction and accumulation.

The hourly chart reveals a cup-and-handle formation, with short-term support between $2.49–$2.50, a bullish continuation pattern.

A late-session recovery after a dip near 21:00 reinforced the technical setup. Furthermore, during the 01:25–01:26 window, volume exceeded 116,000 units as price spiked above $2.55, signaling renewed interest from bulls.

An ascending channel has formed, with support at $2.547 and resistance at $2.562, suggesting potential for continuation toward the $2.58–$2.60 range.

Outlook for NEAR and Altcoin Sentiment

If NEAR maintains its position above key support levels, continued upside could target short-term resistance zones. The asset is increasingly being monitored for short-term trading opportunities and long-term growth potential, especially as altcoins gain attention in late-stage market cycles.

With technical indicators aligning and macro conditions driving capital flows, NEAR Protocol is well-positioned to benefit from the next wave of digital asset demand.