Strong Rebound Signals Potential Trend Reversal After Weeks of Consolidation

NEAR Protocol (NEAR) surged over 10% in the last 24 hours, reclaiming the $2.20 level as bulls defended a major support zone around $1.90. The move came amid a modest recovery across altcoins, highlighting renewed interest in Layer-1 networks following recent sector-wide weakness.

Technical Reversal After Prolonged Downtrend

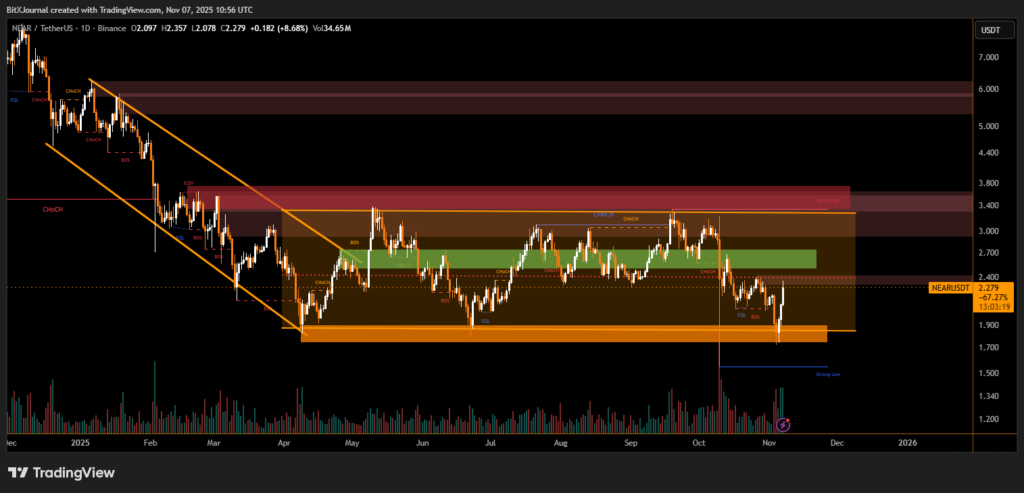

After weeks of sideways trading and a sharp correction earlier this quarter, NEAR showed its first signs of recovery with a break of structure (BOS) on the daily chart. The rebound from the strong demand zone near $1.85–$1.95 was accompanied by a notable uptick in trading volume, suggesting accumulation by market participants anticipating a short-term reversal.

Analysts noted that NEAR’s structure had previously been dominated by lower highs and lower lows since March, but this recent breakout hints at a potential change of character (ChoCH) in market behavior.

“A sustained close above $2.30 could confirm the start of a fresh bullish leg toward the $2.70–$3.00 resistance band,” BitXJournal market analyst commented, adding that buyers appear to be regaining control after months of selling pressure.

Key Resistance Levels and Market Sentiment

The next critical resistance lies between $2.70 and $3.30, where multiple rejection wicks have formed in prior sessions. Above that zone, the chart shows a weak high near $3.50, representing the final barrier before a potential trend continuation.

However, traders remain cautious as macro uncertainty continues to weigh on digital assets. A decisive move above $2.40 on sustained volume would likely strengthen the bullish case.

The recent 10% surge underscores growing confidence in NEAR’s ecosystem fundamentals and its ongoing developer activity within the Layer-1 space. If momentum continues, NEAR could be positioned for a broader recovery toward mid-range resistance, signaling a shift in sentiment across the altcoin market.

NEAR’s ability to hold above $2 remains the key factor determining whether this rebound evolves into a larger structural reversal.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.