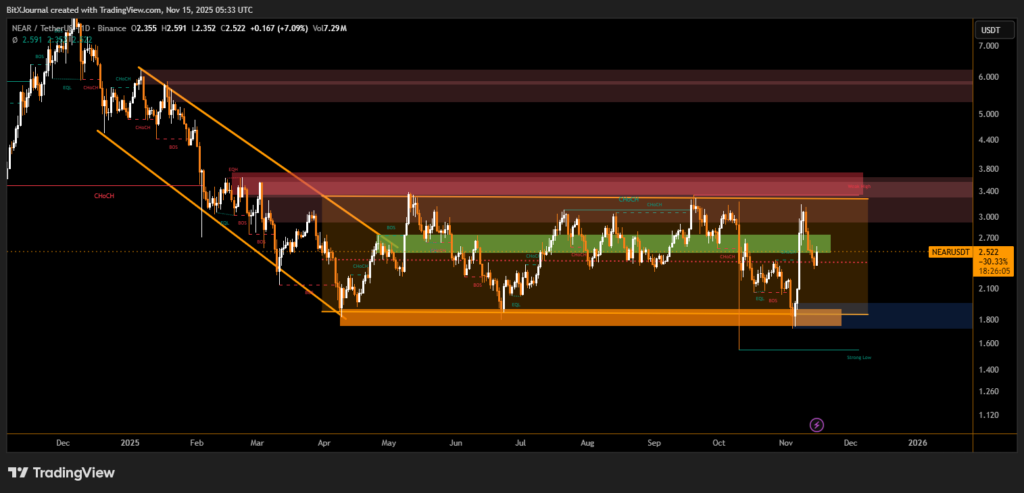

NEAR/USDT Daily Chart Highlights Tight Consolidation and High-Impact Liquidity Levels

NEAR Protocol’s market structure is entering a critical phase as the asset continues to trade within a narrow multi-month range defined by layered supply and demand zones. The latest NEAR/USDT daily technical picture reveals that the token is oscillating between heavy overhead supply near $3.40 and deep demand support below $1.90, signaling a potential buildup toward a decisive breakout. Analysts say that the prolonged compression is a signal traders should not ignore.

Supply Pressure Dominates Upper Structure

The chart reflects a substantial sell-side block stretching from roughly $3.10 to $3.80, an area repeatedly tested but not reclaimed. A sequence of earlier Breaks of Structure (BOS) and Change of Character (ChoCH) events confirms how bears have consistently defended these upper levels.

These overlapping supply zones illustrate a strong defensive ceiling that the price must overcome for any meaningful trend reversal.

BitXJournal market observer notes, “The thick supply band overhead shows that liquidity sits above every minor rally. Until NEAR can close above these levels, upward momentum will likely remain limited.”

Demand Zone Stability Tested After Multiple Sweeps

On the lower end, the chart marks an extensive demand region between $1.70 and $1.95, an area that has attracted aggressive buying during each downward probe. This region includes a labeled Strong Low, reinforcing its importance for long-term market structure.

The repeated sweeps into this demand region demonstrate both vulnerability and resilience, making it a pivotal area for future direction.

BitXJournal technical strategist explains, “Buyers have stepped in every time price tapped the lower range. But the more a level is tested, the weaker it can become. If this zone fails, deeper retracements may develop.”

Compressed Mid-Range Structure Signals Imminent Move

Within the range, NEAR continues to form equilibrium patterns and internal BOS signals, shown in tight consolidations around the green mid-range. This suggests an accumulation or distribution phase still in progress.

<u>With price near $2.54, NEAR remains inside a neutral pocket where neither buyers nor sellers hold decisive control.</u>

NEAR’s prolonged sideways structure implies that an expansion move is approaching. A breakout above the major supply ceiling could trigger a trend shift, while a breakdown beneath the strong demand floor would likely open the door to new multi-month lows. Traders are watching these boundaries closely as volatility compresses and liquidity builds.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.