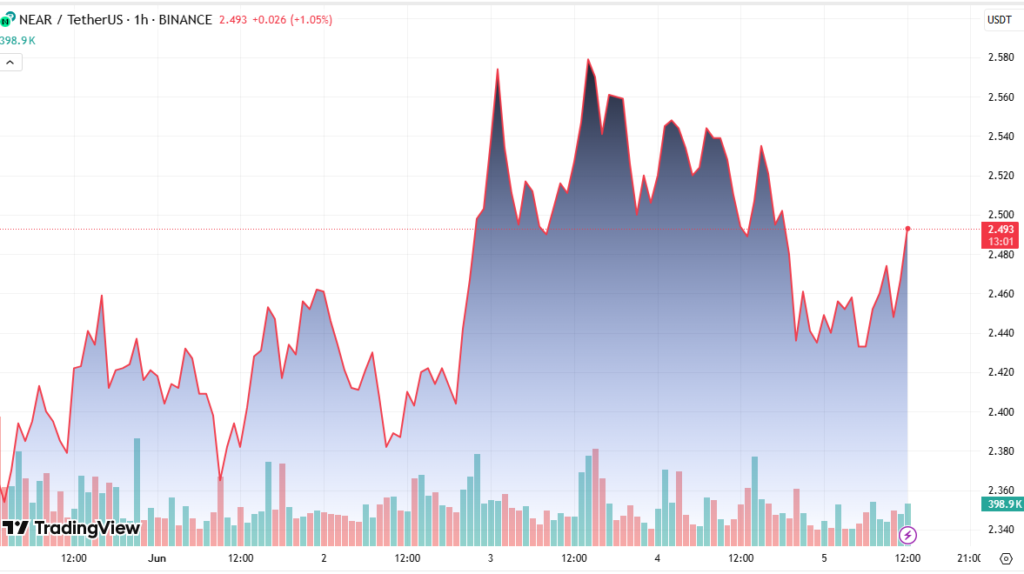

NEAR Protocol (NEAR) has rebounded impressively from recent market pressure, showing early signs of a bullish reversal. The asset recovered from a sharp 5.2% decline, finding critical support at $2.42 and rallying with renewed buyer interest.

Resilience Amid Market Uncertainty

NEAR’s rebound signals underlying strength as global markets face mounting uncertainty. Ongoing trade tensions between major economies and central banks’ inflation-driven policy shifts continue to inject volatility into the broader crypto and financial landscape.

Despite these challenges, NEAR has attracted buying interest, potentially from both retail and institutional players focused on scalable blockchain infrastructure projects.

Accumulation Signs Strengthen Bullish Outlook

Technical indicators show a promising setup:

- Support Level Established: NEAR dropped to $2.42 on June 4 with a spike in volume (2.69M), forming a base of accumulation.

- Double Bottom Formation: A potential double bottom pattern developed, confirmed by increased volume on the second support test — a classic bullish reversal signal.

- Resistance Zone: Resistance formed near $2.46–$2.47, with NEAR attempting to break through this level during early hours of June 5.

These patterns indicate growing confidence among buyers accumulating at lower levels.

Price Action and Volume Insights

NEAR traded within a high-low range of 0.132 (5.2%), reflecting heightened volatility. Notable developments over the last trading hours include:

- 07:15 – Volume spike of 206K supports bullish breakout attempts.

- 07:34 – Price peaks at $2.462, followed by a temporary pullback.

- 07:54 – Final push sees NEAR regain strength, hitting $2.458 before consolidating near $2.455.

This steady recovery, combined with repeated defense of the $2.42 level, reinforces a bullish near-term structure.

Conclusion: Bullish Momentum Building

As institutional interest in blockchain infrastructure continues to grow, NEAR’s recent performance may reflect more than a short-term technical bounce. Sustained buying above the $2.46 resistance could confirm a trend reversal, potentially setting the stage for a broader rally.

In an environment of global macroeconomic shifts, NEAR’s strength may attract further attention from long-term investors seeking utility-based digital assets with upside potential.