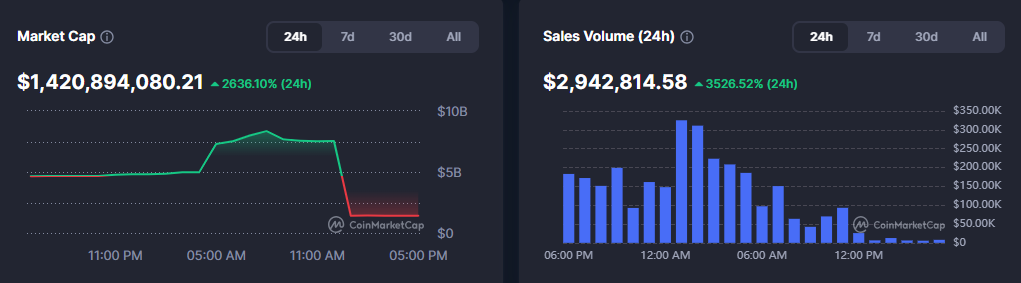

The global NFT market has retraced sharply, with total market capitalization slipping below $1.5 billion, a level last seen before the sector’s explosive growth phase in 2021.

NFT Market Decline Mirrors Broader Crypto Selloff

The downturn has unfolded alongside a wider correction across digital assets. Over the past two weeks, the total cryptocurrency market value dropped from around $3.1 trillion to roughly $2.2 trillion. During the same period, bitcoin fell from near $89,000 to the mid-$60,000 range, while ether declined from about $3,000 to below $2,000. These two networks continue to dominate NFT trading activity, making their price movements closely tied to NFT valuations.

NFT Supply Grows as Demand Weakens

A key driver behind the market reset is the widening gap between supply and demand. NFT minting accelerated throughout 2025, pushing the total number of NFTs in circulation to nearly 1.3 billion, a year-over-year increase of about 25%. At the same time, total NFT sales dropped 37% to approximately $5.6 billion, and average sale prices fell below $100.

This imbalance reflects lower barriers to minting and cheaper issuance, while buyer participation and spending have failed to keep pace.

The contraction has been reinforced by a series of corporate exits and platform shutdowns. Several well-known NFT marketplaces and studios have scaled back or closed operations entirely, citing prolonged weak demand and unsustainable business models, further underscoring the sector’s ongoing consolidation.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.