Government Takes Major Step Toward Legalizing and Overseeing Crypto Sector

Pakistan has officially announced the creation of a Digital Asset Regulatory Authority (DARA) to oversee and regulate the growing use of cryptocurrencies and other digital assets in the country. This move comes amid increasing adoption of crypto in the region and global calls for clear regulatory frameworks.

The announcement was made by officials from the Ministry of Finance and the State Bank of Pakistan, with the goal of promoting innovation while protecting consumers and the financial system.

“This marks a new era of financial transparency and digital innovation in Pakistan,” said Finance Minister Muhammad Aurangzeb.

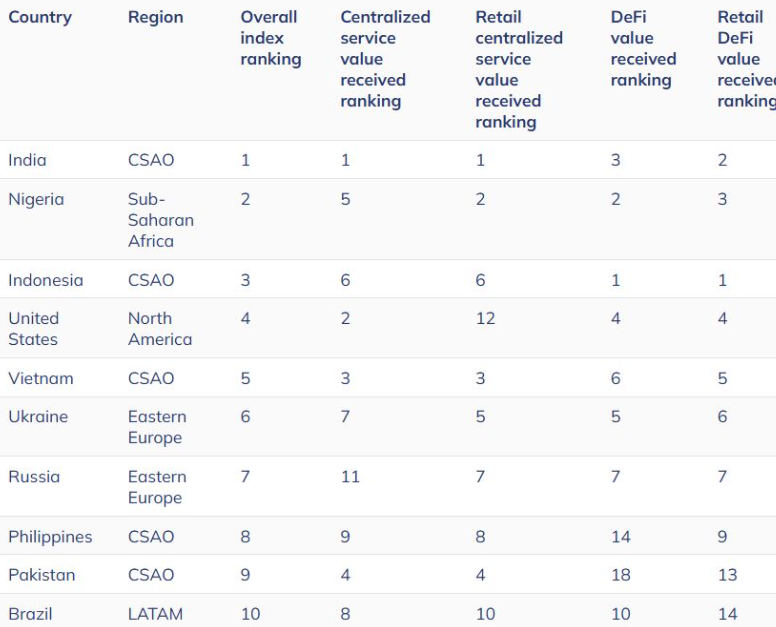

Pakistan ranked highly in Chainalysis’ 2024 crypto adoption index, coming in 9th.

What Will the Digital Asset Authority Do?

The newly established DARA will have the responsibility to:

- Develop and implement crypto regulations

- Grant licenses to exchanges and crypto service providers

- Monitor and prevent illegal crypto-related activities

- Create investor protection frameworks

- Collaborate with global regulatory bodies

By creating this body, Pakistan aims to regulate crypto in a balanced way — encouraging innovation while managing risks such as fraud, money laundering, and illicit finance.

“The purpose is not to ban crypto, but to supervise and integrate it into the legal economy,” noted a senior official at the central bank.

Why This Is a Big Deal for Pakistan’s Crypto Ecosystem

Crypto adoption in Pakistan has surged in recent years, with Chainalysis ranking it among the top 10 countries in terms of crypto adoption in 2023. Despite the demand, the lack of regulatory clarity pushed many investors into informal and risky channels.

The new authority aims to change that by creating a safe, transparent, and legally compliant ecosystem for digital assets.

This move also signals to foreign investors and crypto companies that Pakistan is ready to embrace the future of finance under a clear legal framework.

Industry Reactions Are Largely Positive

Leading voices from Pakistan’s tech and fintech sectors welcomed the decision. Many believe this step could unlock new avenues for blockchain innovation, crypto trading, and decentralized finance (DeFi) within the country.

“This is exactly what we needed — a structured environment to legitimize crypto businesses in Pakistan,” said the CEO of a local exchange.

Next Steps: Licensing, Compliance, and Public Education

The government plans to roll out the first set of rules in the coming months, with exchange registration and compliance reporting set to begin later this year. Education campaigns will also follow to help the public understand how to engage safely with digital assets.

A New Chapter for Digital Finance in Pakistan

With the creation of the Digital Asset Authority, Pakistan has joined the ranks of countries taking proactive steps to regulate crypto. As the global crypto landscape evolves, Pakistan is now positioned to become a serious player in the regulated digital finance space.