Company Blends Crypto with Commodities for Bold Acquisition Strategy

UK-based mineral exploration firm Panther Metals Plc (PALM) jumped 21% on the London Stock Exchange Monday after announcing a £4 million ($5.4 million) Bitcoin treasury strategy. The move marks a pioneering blend of physical commodities and digital assets, aimed at reshaping how natural resource companies fund expansion.

Panther will use £1.3 million ($1.75 million) worth of Bitcoin as collateral to acquire the Pick Lake mining deposit in Ontario, Canada.

Bitcoin as “Productive Capital”

Rather than passively holding Bitcoin, Panther plans to leverage BTC as a financial tool, allowing the company to retain crypto exposure while securing physical mineral assets. According to CEO Darren Hazelwood, the firm’s hybrid approach allows Panther to fund premium mining projects with minimal dilution to shareholders by capitalizing on more favorable lending terms in the crypto space.

“In today’s inflationary and volatile market conditions, Bitcoin acts as a hedge against fiat currency risk,” Hazelwood said.

Pick Lake Deal Backed by BTC

The acquisition targets the Pick Lake deposit, part of the larger Winston Project in Ontario, which holds 85% of the total known mineral resources in the region. The site includes high-grade zinc, copper, and precious metals, positioning Panther in the midst of a global push for critical minerals.

Zinc is a key component for galvanizing steel and battery technologies — both crucial in energy transition efforts.

The remaining £2.7 million in Bitcoin will remain in treasury and may be used to secure future mineral asset deals, creating an agile strategy that combines digital liquidity with hard-asset growth.

Stock Price Jumps, Investor Interest Rises

Panther’s bold move captured investor attention:

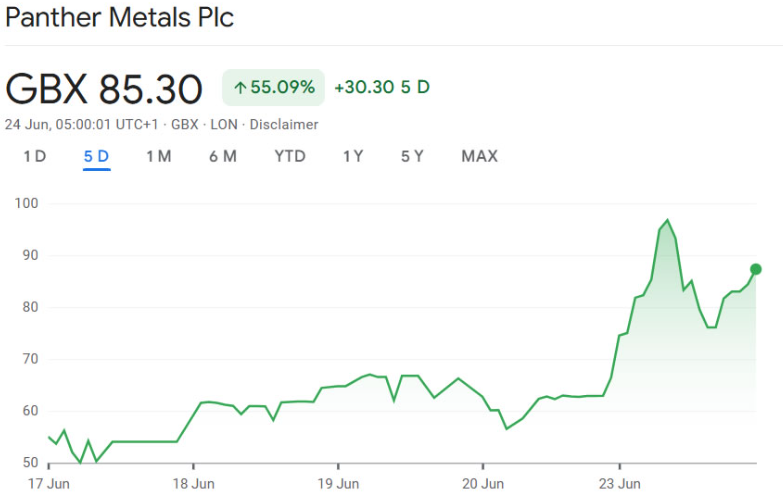

- Shares surged 21% on Monday, adding to a 125% rise over the past month.

- 55% gain just over the past week, according to Google Finance.

Growing Trend of Bitcoin Treasuries

Panther joins a growing list of firms embracing Bitcoin-backed balance sheet strategies. This week, Grant Cardone’s company bought 1,000 BTC, while Michael Saylor’s Strategy and Japan’s Metaplanet increased their crypto holdings to 592,345 BTC and 11,111 BTC, respectively.

Blending digital and physical assets, Panther is now at the forefront of a new era in resource funding.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.