Decentralized prediction platform Polymarket hits new user and volume milestones ahead of its U.S. relaunch and token airdrop, while regulated rival Kalshi cements dominance.

Prediction markets are heating up again, with Polymarket recording an explosive rebound in October 2025, reaching record levels in trading activity, user participation, and market creation. The surge comes as the platform prepares for a U.S. relaunch and teases an upcoming POLY token airdrop — a move that has drawn renewed interest from crypto traders and yield seekers alike.

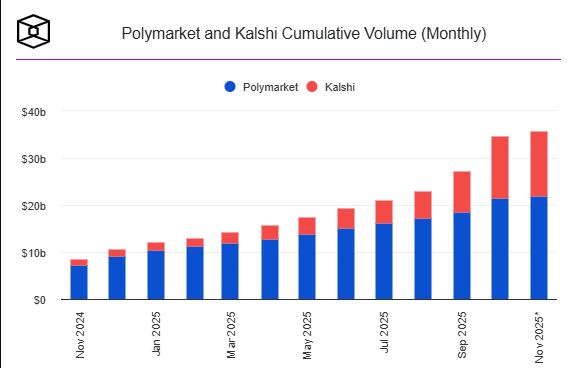

At the same time, Kalshi, a U.S.-regulated platform, has continued to dominate in total volume, processing $4.4 billion in October, surpassing Polymarket’s performance for the second consecutive month.

Polymarket’s Record Month

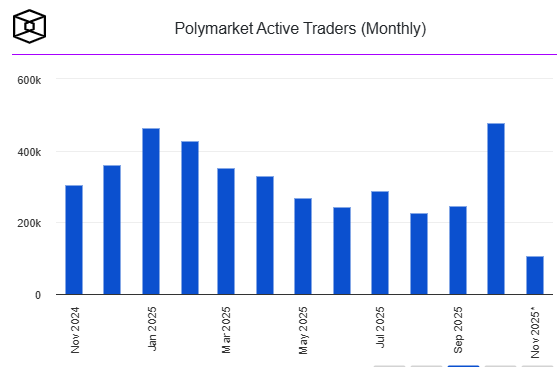

According to recent data, Polymarket’s monthly active traders climbed to an all-time high of 477,850 in October, up 93.7% from September’s 246,610. This rebound marks a dramatic recovery from August’s low of 227,420 traders.

The platform also achieved a record monthly trading volume of $3.02 billion, breaking past its earlier ceiling of $1 billion and signaling rising retail and institutional interest in decentralized prediction markets. In addition, 38,270 new markets were created last month — nearly triple the number recorded in August.

“October saw a jump in activity as crypto traders shared new strategies to earn from liquidity providing, arbitrage, and information asymmetry due to Polymarket’s decentralized access,” said Nick Ruck, director at LVRG Research.

“As anticipation builds for platform token releases, the sentiment is entirely different from last year, when retail users were mostly gambling on political and sports events.”

Token Launch and U.S. Relaunch Plans

Polymarket’s growth coincides with rising expectations for its native POLY token and upcoming airdrop, confirmed by Chief Marketing Officer Matthew Modabber. Such announcements often attract high on-chain activity as users aim to qualify for potential token rewards.

The platform also plans to relaunch in the U.S. by the end of November, marking a major comeback after its 2022 settlement with the U.S. Commodity Futures Trading Commission (CFTC), which included a $1.4 million penalty. Since then, regulatory attitudes have softened, with the CFTC showing greater openness to innovation in event-based finance.

Kalshi Maintains Market Leadership

Meanwhile, Kalshi continues to dominate the prediction market sector, achieving $4.4 billion in trading volume in October. The firm’s rapid growth has drawn the attention of major venture capital investors, with Bloomberg reporting proposals valuing Kalshi as high as $12 billion. Earlier in October, it raised $300 million at a $5 billion valuation.

Polymarket’s resurgence and Kalshi’s expanding dominance highlight a maturing prediction market landscape — where decentralized and regulated models are both thriving.

As tokenization, liquidity incentives, and regulatory acceptance evolve, these platforms are redefining how traders interact with real-world events, positioning prediction markets as a key sector in the future of on-chain finance.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.