Uncertainty around US digital asset legislation weighs on institutional investor sentiment

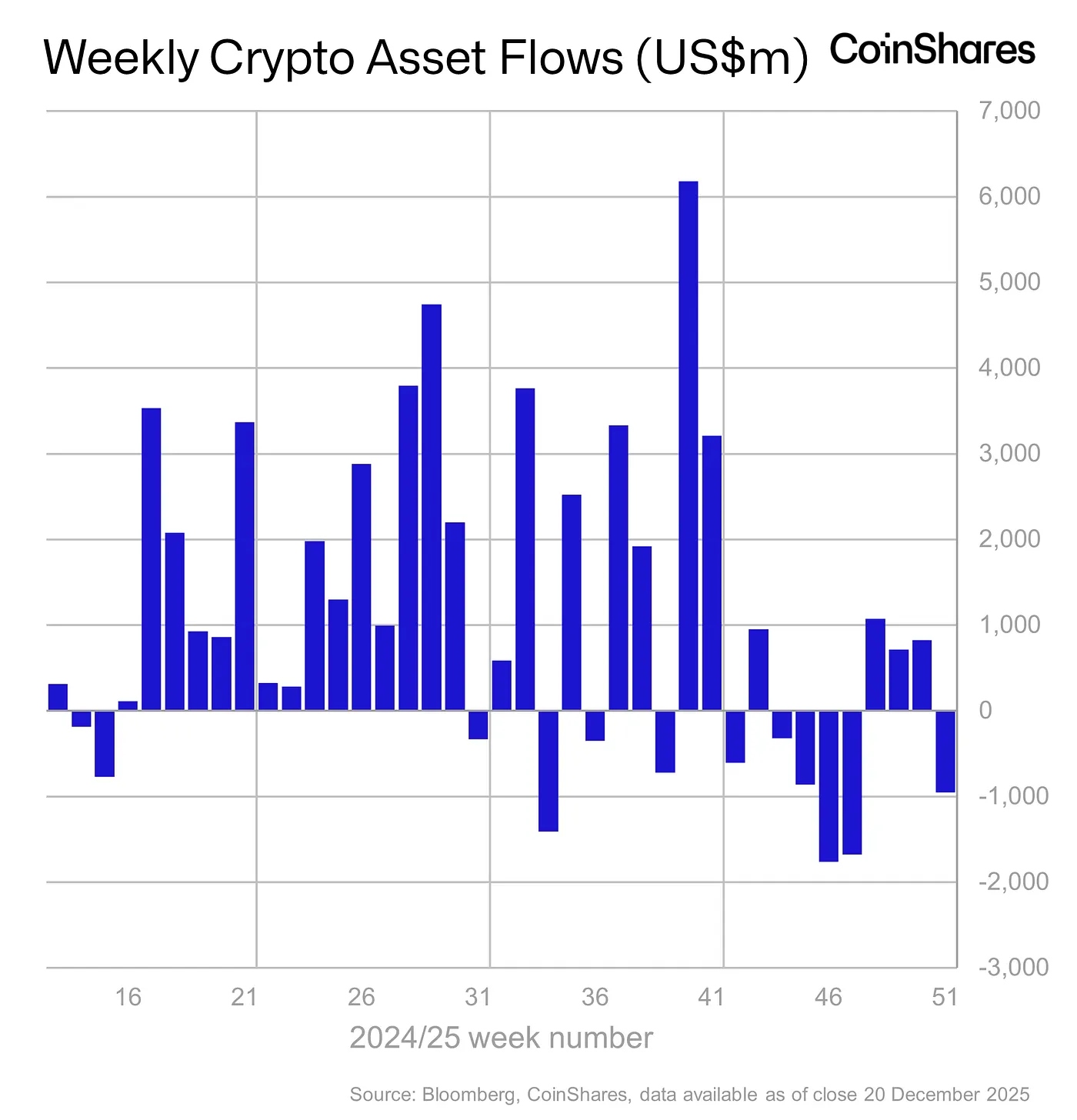

Global crypto exchange-traded products (ETPs) recorded a sharp reversal in investor flows last week, with nearly $1 billion exiting the market. The pullback follows delays in US digital asset legislation, reigniting regulatory uncertainty and prompting risk-off behavior among institutional investors.

Crypto investment products saw $952 million in net outflows over the past week, marking the first weekly decline in four weeks and the largest monthly outflow recorded this year. The shift comes as progress on the long-anticipated US Clarity Act was postponed, extending uncertainty around digital asset classification, exchange oversight, and issuer compliance requirements.

Outflows were overwhelmingly concentrated in the US, which accounted for $990 million in net withdrawals. In contrast, other regions showed relative resilience. Canada recorded $46.2 million in inflows, while Germany added $15.6 million, suggesting that regulatory hesitation in Washington had a disproportionate impact on US-based products.

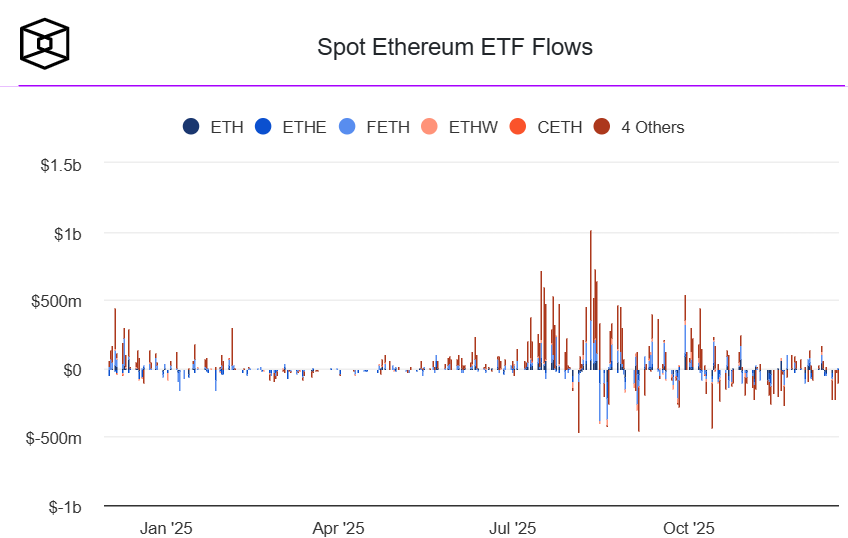

Ethereum linked ETPs experienced the largest asset-specific outflows, totaling $555 million. Analysts note that Ethereum is particularly sensitive to regulatory outcomes due to its central role in market structure debates. Bitcoin products followed with $460 million in outflows, signaling softer demand from US institutions compared with the previous cycle.

Despite the broader sell-off, some assets attracted fresh capital. Solana saw $48.5 million in inflows, while XRP gained $62.9 million, extending a trend of selective allocation toward alternative large-cap tokens.

Total crypto ETP assets under management now stand at approximately $46.7 billion, below last year’s peak. With legislative clarity delayed, analysts suggest it is increasingly unlikely that inflows in 2025 will surpass the prior cycle’s record, underscoring how closely institutional demand is tied to regulatory certainty.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.