Partnership with Securitize strengthens institutional adoption of tokenized real-world assets

Ripple’s enterprise-focused stablecoin RLUSD has been integrated into the tokenization platform Securitize, creating a new liquidity pathway for institutional investors. The move allows holders of BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) and VanEck’s Treasury Fund (VBILL) to seamlessly convert their tokenized shares into RLUSD, providing instant access to stable digital cash.

RLUSD Brings Institutional-Grade Liquidity

The partnership introduces a smart contract that enables real-time redemption of fund shares into Ripple’s stablecoin. This allows investors to exchange holdings for RLUSD and use it for onchain transfers and settlement at any time.

Carlos Domingo, CEO of Securitize, called the move a breakthrough: “Partnering with Ripple to integrate RLUSD into our tokenization infrastructure is a major step forward in automating liquidity for tokenized assets.”

Ripple emphasized that RLUSD was created with institutional use cases in mind, citing its focus on regulatory clarity, price stability, and enterprise adoption. Jack McDonald, Ripple’s head of stablecoins, said: “As adoption grows, partnerships with trusted platforms like Securitize are key to unlocking new liquidity and enterprise-grade use cases.”

Tokenized Funds Gain Momentum

Securitize has already facilitated $4 billion worth of tokenized real-world assets (RWAs), with BlackRock and VanEck playing central roles.

- BlackRock’s BUIDL, launched in March 2024, surpassed $1 billion in assets under management within its first year, making it one of the largest institutional tokenized funds.

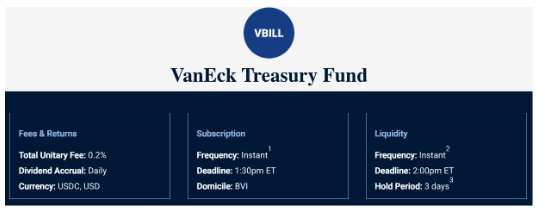

- VanEck’s VBILL, introduced in May 2025, offers exposure to tokenized U.S. Treasury-backed assets, available across multiple blockchains including Ethereum, Solana, Avalanche, and BNB Chain.

The addition of RLUSD as an off-ramp alongside existing stablecoin options like USDC expands the utility of these funds.

The integration underscores the broader trend of real-world asset tokenization, a sector now estimated to represent over $30 billion in value onchain. By offering instant redemption through a regulated stablecoin, BlackRock, VanEck, and Ripple are shaping the future of institutional finance.

The move highlights a growing belief that tokenized funds and stablecoins will serve as the foundation of next-generation financial markets.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.