Analysts say Bitcoin’s increasing liveliness shows strong underlying demand even as price consolidation continues.

A key on-chain indicator known as Bitcoin liveliness has climbed to fresh highs, reinforcing the view among analysts that the current bull market cycle may still have room to run. Despite recent price stagnation, the behavior of long-term holders and renewed transactional activity suggests continued strength beneath the surface.

Bitcoin Liveliness Indicator Shows Persistent Demand

Analysts monitoring on-chain trends note that liveliness continues to rise even as Bitcoin trades lower, a pattern typically associated with active bull phases. The metric measures the balance between long-term holding and spending behavior, increasing when aged coins move and decreasing when supply remains dormant.

Technical analysts highlight that rising liveliness reflects a surge in coin transfers at higher valuations, signaling new capital entering the market. This cycle marks the first time liveliness has broken out of its range that held firm since 2017, pointing to a shift in long-term holder behavior.

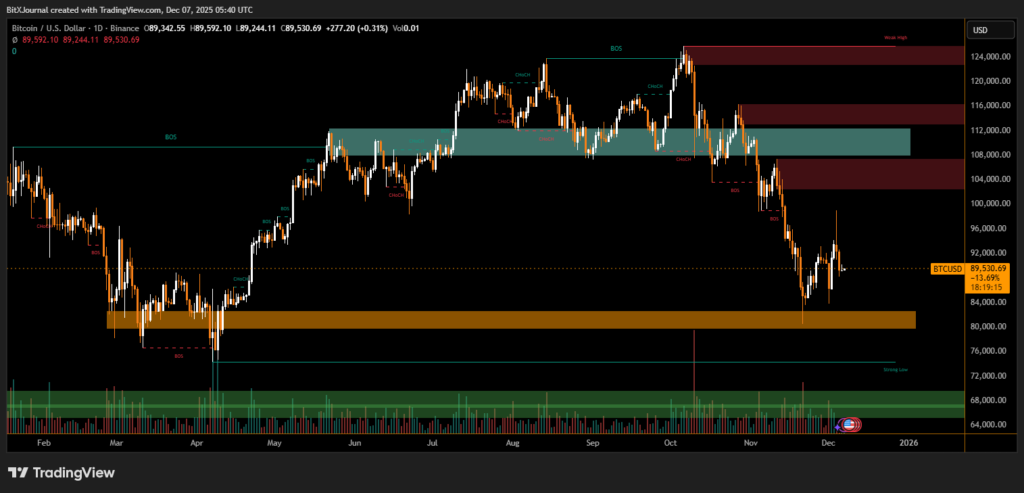

Bitcoin remains stable around the mid-$89,000 range after briefly dipping below key support. Market watchers view the $86,000–$92,000 band as a consolidation zone, expecting limited movement until one of these boundaries breaks.

Analysts believe a push beyond $92,000 could fuel a renewed rally, while a move toward the low $80,000 range may form a potential double-bottom structure. Despite the short-term uncertainty, several experts argue that Bitcoin may be nearing a cyclical bottom, potentially setting the stage for a stronger advance heading into early next year.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.