Five years after the GameStop trading frenzy exposed weaknesses in traditional market infrastructure, Robinhood is advancing plans to bring tokenized stocks fully onchain. The company aims to enable 24/7 trading, faster settlement, and potential self-custody, positioning blockchain as a structural upgrade to legacy equity markets.

GameStop Fallout Still Shapes Strategy

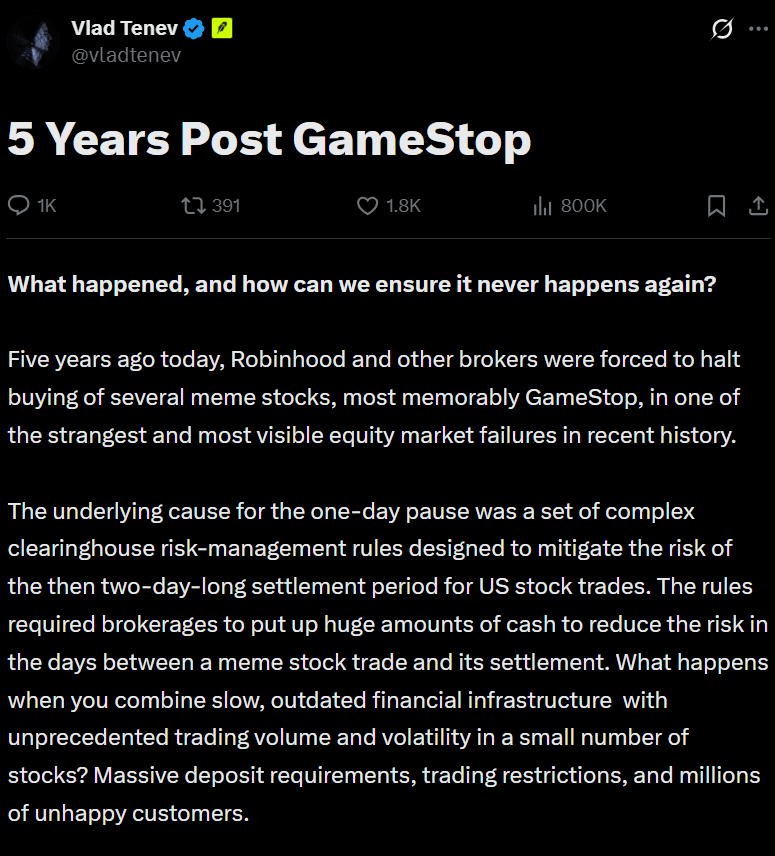

Robinhood’s leadership continues to point to the 2021 trading halts as a turning point. At the time, extreme volatility combined with multi-day settlement cycles forced brokers to post significant collateral, leading to temporary restrictions on popular stocks. While U.S. equities have since moved to 24-hour settlement, residual risks remain during weekends and holidays, when exposure can stretch across several days.

Tenev wrote in an X post;

Why Tokenization Matters

Tokenized equities are presented as a way to reduce these pressures. By settling trades near real time on blockchain rails, tokenization can lower systemic risk and reduce reliance on clearing intermediaries. Additional features include fractional ownership and continuous trading, capabilities that traditional equity systems do not natively support.

Current Rollout and Expansion Plans

Robinhood began offering tokenized U.S. stocks to European users in mid-2025, providing access to over 2,000 equities with extended trading hours. These tokens track price movements and dividends without requiring direct share ownership.

The expansion into full 24/7 onchain trading and self-custody depends heavily on regulatory clarity. Clear legislative frameworks are seen as essential to ensure compliance and prevent abrupt policy reversals as tokenized equities move closer to the U.S. market.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.