Chainalysis report shows nearly 50% rise in crypto inflows, highlighting Russia’s growing use of digital assets for financial operations.

Russia’s Crypto Adoption Surges Amid Economic Realignment

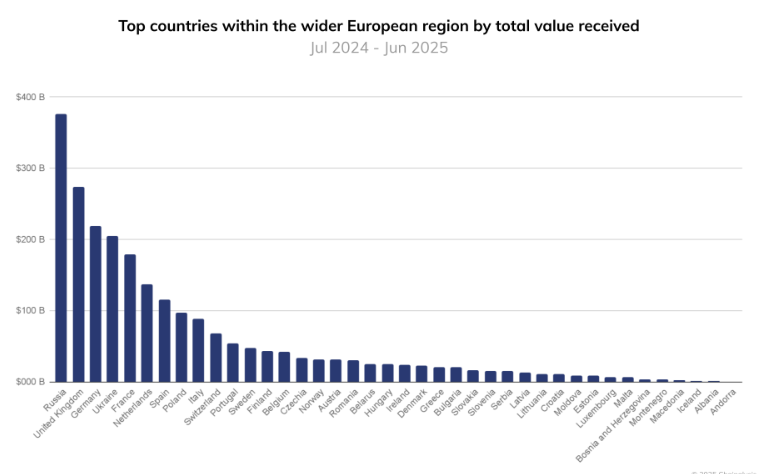

Russia has emerged as Europe’s top crypto market, outpacing traditional financial hubs like the United Kingdom and Germany, according to recent blockchain data. The country received an estimated $376.3 billion in digital assets between July 2024 and June 2025, marking a 48% increase compared to the previous year.

The findings, drawn from Chainalysis’ latest European Crypto Adoption report, combine regions previously analyzed separately — covering Central, Northern, Western, and Eastern Europe — to present a more unified picture of crypto activity across the continent.

“For this year’s analysis, we’ve reorganized our regional classifications to better reflect both current crypto activity and geopolitical realities,” the report noted.

Institutional Growth and DeFi Adoption Drive Expansion

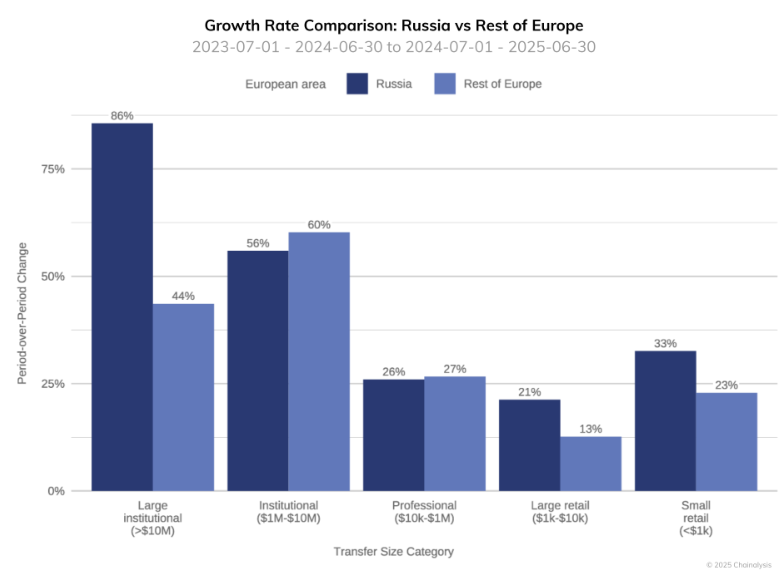

Analysts attribute Russia’s rapid expansion in the crypto space to two main catalysts: a surge in large-scale institutional transfers and an explosion in decentralized finance (DeFi) participation.

Large transactions exceeding $10 million rose 86% year-over-year, nearly doubling the growth rate of other European regions. “The scale of institutional activity is particularly notable,” the report added, pointing to evidence that Russia’s financial entities are increasingly experimenting with blockchain-based financial infrastructure.

Meanwhile, DeFi adoption has skyrocketed, growing nearly eightfold in early 2025, signaling the nation’s pivot toward on-chain financial services and liquidity markets.

The Role of Stablecoins and Cross-Border Payments

One of the most striking developments is the rise of the A7A5 ruble-pegged stablecoin, issued in Kyrgyzstan. Despite facing sanctions, it has become the world’s largest non–US dollar stablecoin by market capitalization, surpassing $500 million in late September.

Experts note that A7A5 is facilitating cross-border settlements for businesses and institutions, offering an alternative payment rail outside the conventional banking system. “Its growth highlights the shift toward blockchain-based financial independence in the region,” one market analyst observed.

Regulatory and Economic Implications

The surge in Russia’s crypto adoption underscores a broader transformation in how nations under regulatory constraints leverage blockchain ecosystems for economic flexibility.

Underlined by both institutional engagement and retail participation, Russia’s crypto-driven financial activity reflects a structural shift in Europe’s digital economy, positioning the country as a critical player in the global crypto landscape.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.