US Regulator Officially Starts the Review Clock

The U.S. Securities and Exchange Commission (SEC) has formally acknowledged the application for a Bitcoin and Ethereum ETF proposed by Trump Media’s Truth Social. This acknowledgment triggers the regulatory countdown, where the SEC must approve or reject the ETF within a set timeline.

The dual crypto ETF aims to provide exposure to both Bitcoin and Ether, offering a combined investment product for digital asset enthusiasts.

ETF Structure: 75% Bitcoin, 25% Ethereum Allocation

According to the official filing, the Truth Social Bitcoin and Ethereum ETF plans to list shares on the NYSE Arca, with its holdings divided into 75% Bitcoin (BTC) and 25% Ether (ETH). The fund will track the daily net asset value (NAV) using reference rates calculated by the CME CF Bitcoin and Ether benchmarks, aggregating trade data from multiple leading exchanges.

Bitcoin and Ether holdings will be stored securely in cold wallets held in separate custody accounts to enhance investor protection.

Fund Management and Custody Details

The ETF will be sponsored by Yorkville America Digital, a growing digital asset manager, while Crypto.com’s Foris DAX Trust Company will serve as the fund’s custodian. Private keys for the assets will be stored in offline cold storage, ensuring a high level of security.

This application is among several recent crypto ETF proposals, reflecting rising institutional interest in regulated digital asset products.

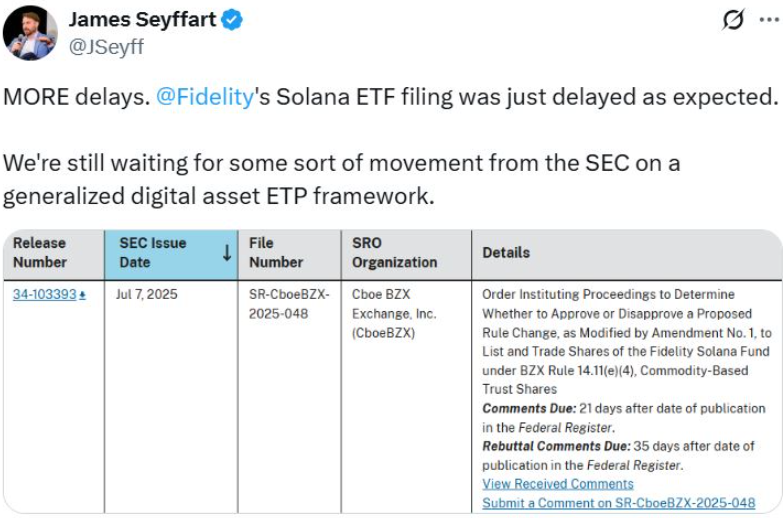

Fidelity’s Solana ETF Faces Further Delays

In contrast to the Truth Social filing, the SEC has again delayed its decision on Fidelity’s proposed spot Solana (SOL) ETF. The delay opens a new public comment period, with responses due within 21 days and rebuttals within 35 days.

The Cboe BZX Exchange first submitted the application to list the Fidelity Solana ETF back in March 2025. The SEC’s latest move, though expected, shows the ongoing cautious approach toward non-Bitcoin crypto ETFs.

Bloomberg analysts suggest that the SEC is slowly moving toward a general framework for digital asset exchange-traded products (ETPs), indicating long-term progress.

Signs of Broader SEC Engagement with Crypto ETPs

Despite the delay, reports have surfaced that the SEC has asked issuers of Solana ETFs to amend and refile their applications. Industry experts interpret this as a positive signal of regulatory engagement rather than rejection.

“Any level of dialogue between the SEC and ETF issuers is a constructive step toward future approvals,” according to ETF analysts.

In short

The SEC’s acknowledgment of the Truth Social Bitcoin and Ethereum ETF represents a significant development for dual-asset crypto products. While regulatory clarity remains a work in progress, continued engagement by the SEC on multiple filings suggests growing momentum for crypto ETF adoption in the U.S. market.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.