Landmark approval gives investors exposure to Bitcoin, Ether, XRP, Solana and Cardano

Introduction

The U.S. Securities and Exchange Commission (SEC) has approved Grayscale’s Digital Large Cap Fund (GLDC), marking the first multi-asset cryptocurrency exchange-traded product (ETP) in the United States. The decision represents a major step in integrating digital assets into mainstream finance and follows the success of recently launched spot Bitcoin ETFs.

A basket of leading cryptocurrencies

The new product will provide investors with exposure to five of the world’s largest cryptocurrencies: Bitcoin (BTC), Ether (ETH), XRP, Solana (SOL), and Cardano (ADA). Unlike buying tokens directly on exchanges, the ETP allows traditional investors to diversify across multiple digital assets through a single regulated instrument.

Market analysts say this approval could act as a catalyst for the broader altcoin market. “The timing is critical — with Bitcoin consolidating, many investors are looking to altcoins for the next leg of growth,” explained one institutional strategist.

Altcoin season expectations rise

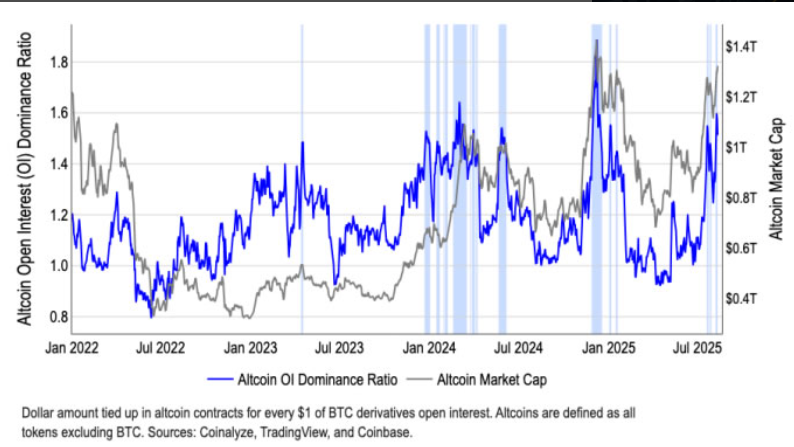

The decision arrives amid rising speculation of an upcoming altcoin season, when non-Bitcoin assets historically outperform. Recent data shows a spike in altcoin open interest dominance, while several firms have forecast a stronger performance for Ethereum, Solana and other major tokens in the months ahead.

“We think current market conditions now suggest a potential shift towards a full-scale altcoin season,” said David Duong, head of institutional research at Coinbase, in a recent report.

New SEC standards speed up approvals

The Grayscale ETP was approved under the SEC’s generic listing standards, which streamline the process for exchange-traded crypto products on major platforms like Nasdaq, NYSE Arca and Cboe BZX. This framework eliminates the need for lengthy case-by-case reviews.

Grayscale CEO Peter Mintzberg commented, “The Grayscale team is working expeditiously to bring the first multi-crypto asset ETP to market with Bitcoin, Ethereum, XRP, Solana and Cardano. This is a milestone for both our company and the broader industry.”

The SEC’s approval underscores a shift toward greater regulatory clarity, especially following years of enforcement-heavy actions against crypto companies. With this green light, U.S. investors now have a regulated pathway to gain diversified crypto exposure, signaling that Wall Street is opening more doors for digital assets.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.