Rising legal pressure on privacy tools pushes regulators and crypto leaders to confront emerging tensions

The U.S. Securities and Exchange Commission’s Crypto Task Force will convene a dedicated roundtable on privacy and financial surveillance on Dec. 15, marking one of the agency’s most direct engagements with the topic as it gains renewed urgency across the digital asset sector.

Similar to prior SEC roundtables, the session will gather industry executives, legal specialists and agency officials to discuss areas of concern and potential pathways for collaboration. The event is not expected to produce formal policy proposals, but it signals increased regulatory attention to a debate that has intensified throughout 2024.

Legal Cases Rekindle Debate Over Digital Privacy

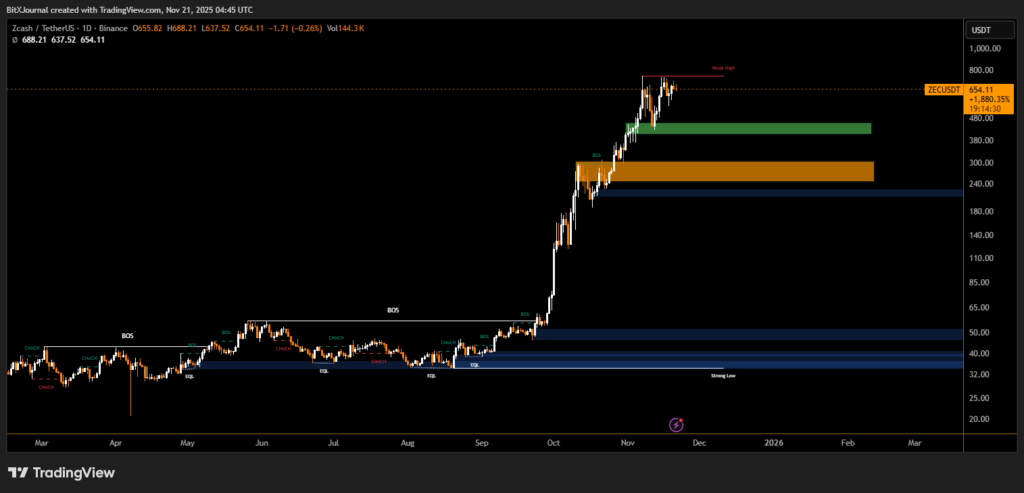

Interest in privacy reached new heights following two high-profile developments: the partial guilty verdict in the Tornado Cash developer Roman Storm case, and the November sentencing of a Samourai Wallet developer. The momentum has also coincided with a sharp rally in privacy-focused tokens such as Zcash.

“Authoritarians thrive when people have no privacy. When those in charge start being hostile to privacy protections, it is a major red flag,” said Naomi Brockwell, founder of the Ludlow Institute. Advocates argue that recent prosecutions threaten the open-source principles on which much of the crypto ecosystem was built.

Privacy has long been one of the core motivations behind cryptographic systems, dating back to the cypherpunk movement, which emphasized secure communication in adversarial environments.

Developers Face Increased Scrutiny

Legal experts have warned that the Tornado Cash and Samourai cases could set a troubling precedent, potentially exposing developers to criminal liability simply for creating privacy-preserving tools. Industry advocates say this chilling effect is already discouraging innovation.

Journalist and privacy advocate Lola Leetz criticized the government’s approach, arguing that blaming developers for misuse is comparable to accusing a carmaker of wrongdoing because criminals use their vehicles. “People should not be held accountable for what other people do with the tools they build,” she said.

Recent comments from the Department of Justice suggest a shift, however. In August, acting Assistant Attorney General Matthew Galeotti stated that “merely writing code, without ill intent, is not a crime,” adding that prosecutors should avoid using indictments to redefine the boundaries of acceptable innovation.

What the December Roundtable Signals

The SEC’s upcoming discussion arrives at a moment when privacy is both a technological priority and a regulatory flashpoint. The agency’s willingness to publicly engage the issue reflects growing recognition that privacy tools are integral to the future of digital finance, even as policymakers seek guardrails to prevent abuse.

Participants are expected to explore where constitutional rights, technological freedom and financial oversight intersect — a conversation that may shape how privacy standards evolve in 2025 and beyond.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.