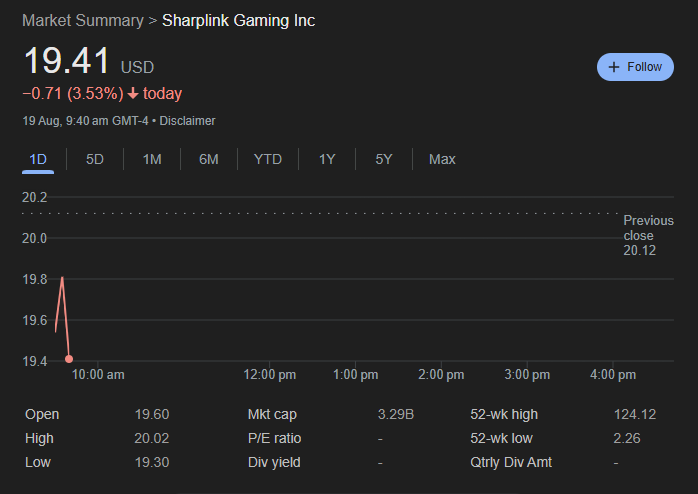

SharpLink Gaming (SBET) has strengthened its position as one of the largest corporate holders of Ethereum, announcing that its Ether (ETH) treasury has climbed to 740,760 tokens following major purchases last week. The total value of these holdings is now over $3.18 billion, though the firm’s pace of acquisition remains behind rival BitMine Immersion Technologies (BMNR).

$537 Million Raised to Fund ETH Purchases

To finance the accumulation, SharpLink raised $537 million in net proceeds during the week ending August 15, 2025. The breakdown included:

- $390 million through a registered direct offering, which closed on August 11.

- $146.5 million via its at-the-market issuance program.

These proceeds allowed the company to acquire 143,593 ETH last week alone, at an average price of $4,648. However, ETH prices have since retreated below $4,300, putting the firm’s latest purchases slightly under water in the short term.

Joe Lubin’s Strategic Treasury Pivot

Led by Ethereum co-founder Joe Lubin, SharpLink has aggressively shifted its treasury strategy since late May. The Minneapolis-based company began focusing on Ethereum accumulation and staking, aiming to generate long-term yield through network rewards.

This bold pivot has positioned SharpLink as one of the most notable institutional players in Ethereum’s ecosystem, placing it alongside names like BitMine in terms of treasury scale.

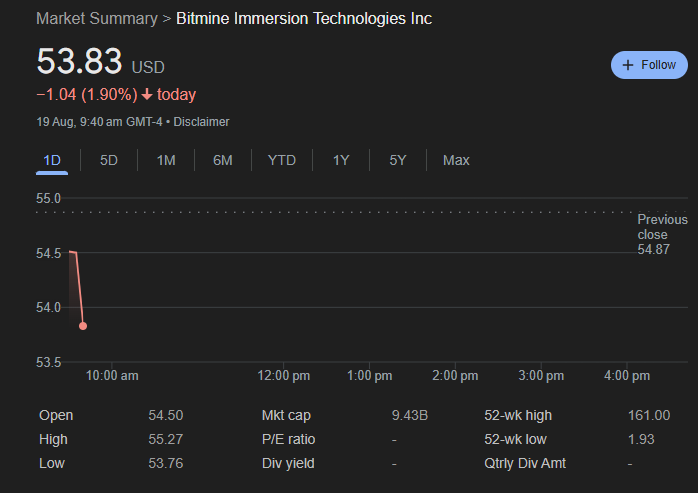

Despite the impressive growth, SharpLink’s ETH holdings still trail BitMine’s aggressive pace:

- SharpLink: 740,760 ETH worth $3.18 billion.

- BitMine: Over 1.5 million ETH, worth about $6.6 billion—nearly double SharpLink’s total.

The comparison underscores that while SharpLink has quickly become a major holder, it has not yet caught up to the market leader in Ethereum corporate accumulation.

Remaining Capital and Market Positioning

Importantly, SharpLink reported that it still has over $84 million in cash available for further ETH purchases. This liquidity provides flexibility to expand holdings if market conditions present opportunities.

However, with ETH’s recent dip below $4,300, investors will closely watch whether SharpLink continues buying at discounted prices or waits for greater clarity around broader crypto market trends.

The rapid rise of ETH treasury firms highlights growing institutional demand for Ethereum as a store of value and yield-generating asset. Unlike Bitcoin, Ethereum offers staking rewards, making it attractive to corporate treasuries looking to balance growth potential with cash-flow generation.

While short-term volatility means SharpLink’s latest buys are temporarily underperforming, the company’s long-term bet on Ethereum’s network growth could deliver significant upside if ETH adoption and staking yields expand through 2026 and beyond.

SharpLink’s holdings crossing $3.1 billion cements its role as one of the biggest Ethereum treasury firms, even as it lags behind BitMine’s $6.6 billion dominance. With more than $84 million left to deploy, SharpLink is expected to continue expanding its ETH position—reinforcing the broader trend of institutional accumulation in the crypto sector.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.