Shiba Inu (SHIB), the popular meme-based cryptocurrency, remains in a downward trend despite showing some signs of recovery. The sharp drop in SHIB’s daily burn rate by 63% poses a serious challenge to the token’s long-term deflationary goals.

Daily Burn Rate Drops Significantly

The daily burn rate, a key component of Shiba Inu’s deflationary strategy, has dropped by 63% over the last 24 hours. Token burns permanently remove coins from circulation, reducing overall supply and theoretically increasing scarcity.

This significant decline in burn activity threatens to derail SHIB’s deflationary trajectory, which has been central to its investor appeal.

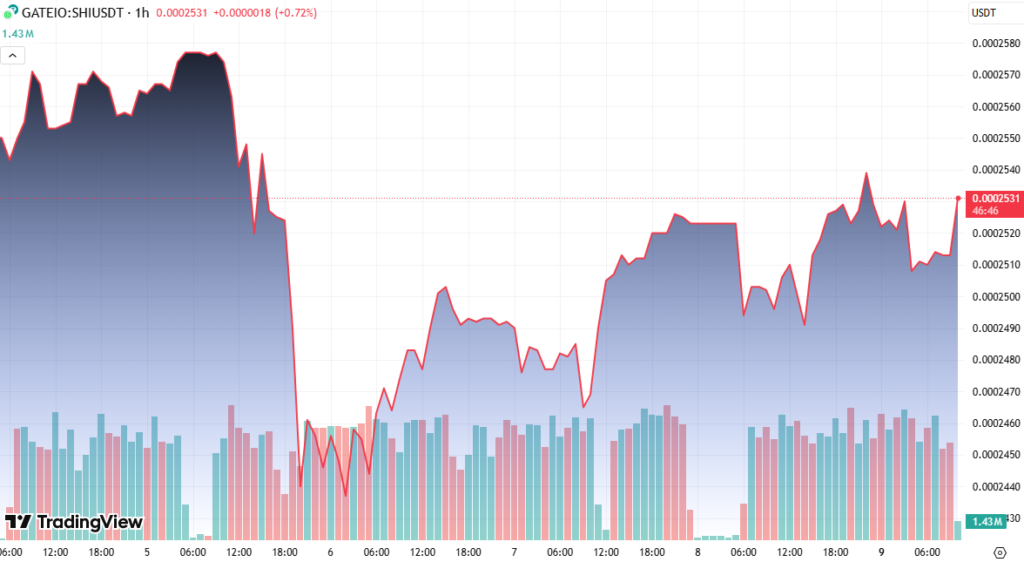

At the time of writing, SHIB is trading near $0.000012650, recovering from a low of $0.00001234 earlier in the day. However, the broader downtrend remains intact, as defined by trendlines from the May 12 and May 23 highs.

Trading Volume Tells a Different Story

Interestingly, trading volume has surged by 78%, indicating increased investor activity despite the bearish price action. In one notable spike, SHIB saw over 14.9 billion in volume at 08:02, suggesting heightened buying interest.

Rising volume amid a price dip could signal accumulation by investors anticipating a reversal or long-term hold.

Technical and On-Chain Insights

Key on-chain data points to strong investor support between $0.000012 and $0.000013. These levels are supported by a concentration of wallet addresses holding SHIB acquired in this price range, hinting at a strong demand zone.

This support band may act as a buffer, with increased likelihood of sideways movement or consolidation before any further directional trend.

Over the last 24 hours, a temporary support level was also identified around $0.00001236, showing accumulation at lower levels. The final hours of trading showed price stabilization, possibly setting the stage for consolidation or a short-term bounce.

Conclusion

While SHIB’s downtrend is technically intact, there are signs of resilience in trading volume and support at key levels. However, the sharp decline in the daily burn rate is a concern, potentially weakening the token’s deflationary appeal. Investors will closely monitor whether this slowdown continues or if activity picks up around critical support levels between $0.000012 and $0.000013.