PayPay-Binance Japan Partnership Strengthens Crypto Accessibility and Cashless Finance in Japan

In a major move signaling Japan’s accelerating shift toward digital finance, SoftBank’s mobile payment arm, PayPay, has acquired a 40% equity stake in Binance Japan, the local subsidiary of global cryptocurrency exchange Binance. The strategic deal, finalized in September 2025, makes Binance Japan an equity-method affiliate of PayPay, underscoring the deepening relationship between Japan’s fintech and cryptocurrency sectors.

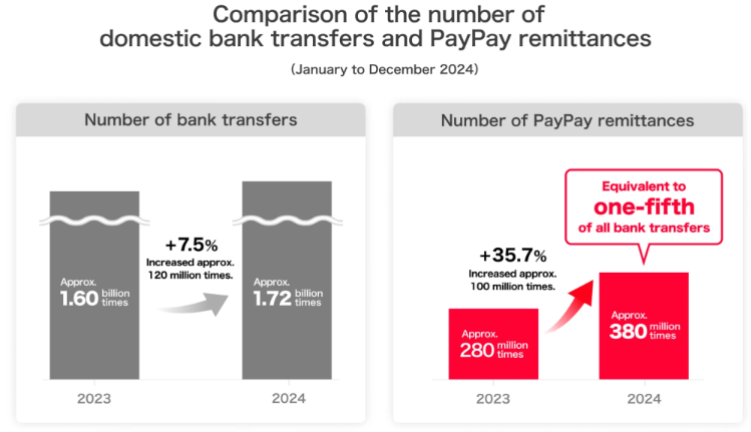

Launched by SoftBank in 2018, PayPay surpassed 70 million users in July 2025, solidifying its dominance in Japan’s mobile payments market. The company processed over 380 million remittances in 2024, marking a 36% increase from the previous year’s 280 million. By comparison, traditional bank transfer volumes rose only 7.5%, highlighting PayPay’s accelerating role in Japan’s cashless economy.

According to the joint announcement, PayPay and Binance Japan will collaborate to integrate PayPay Money with Binance’s trading platform, allowing users to buy and sell crypto assets directly through Japan’s most popular cashless payment service. The initiative is aimed at expanding access to digital assets while enhancing transaction security and convenience for millions of Japanese users.

“Through its continued evolution from a cashless payments business into a digital financial platform, PayPay will strive to deliver new value to users while contributing to the advancement of Japan’s financial infrastructure,” the company stated.

PayPay’s Rapid Growth and Market Leadership

“By investing in Binance Japan, we will provide users with solutions that combine the convenience and security of PayPay with the innovation of Binance,” said Masayoshi Yanase, PayPay’s corporate officer.

Strengthening Japan’s Web3 Ecosystem

Binance Japan’s General Manager, Takeshi Chino, emphasized that the partnership will make Web3 technologies more accessible across the country. “By combining PayPay’s extensive user base with Binance’s innovative technology, we can deliver secure, seamless digital asset services,” Chino noted.

PayPay’s Global Ambitions and U.S. Listing Plans

In addition to local expansion, PayPay is pursuing global growth. The company confidentially filed for a U.S. listing in August 2025, seeking to issue American depositary shares on a major stock exchange. While details of the listing—including timing and valuation—remain undisclosed, it marks PayPay’s entry into international capital markets.

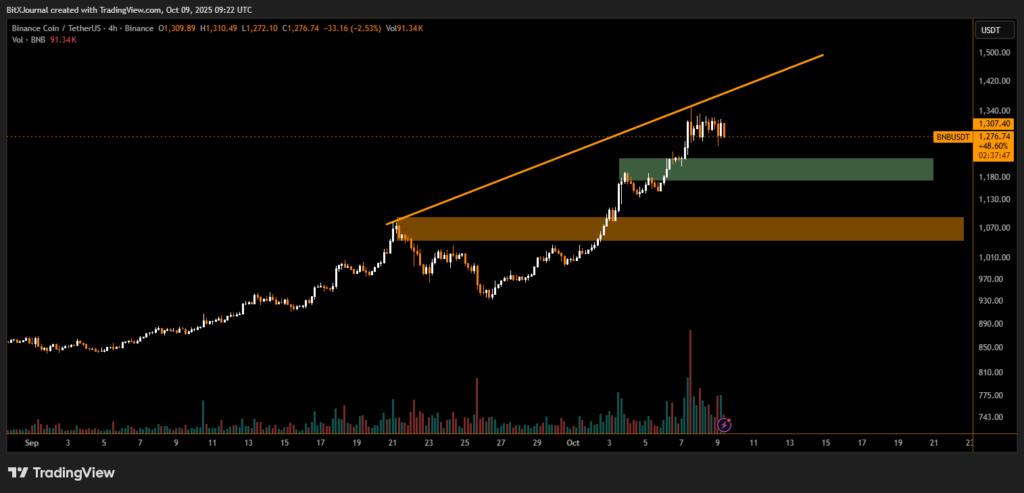

The acquisition comes amid a strong rally in BNB, Binance’s native token, which has surged 48% since early September, boosting its market capitalization by about $60 billion. The timing highlights growing investor confidence in the integration of fintech and crypto ecosystems in Japan’s evolving financial landscape.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.