Solana shows resilience despite recent price pressure

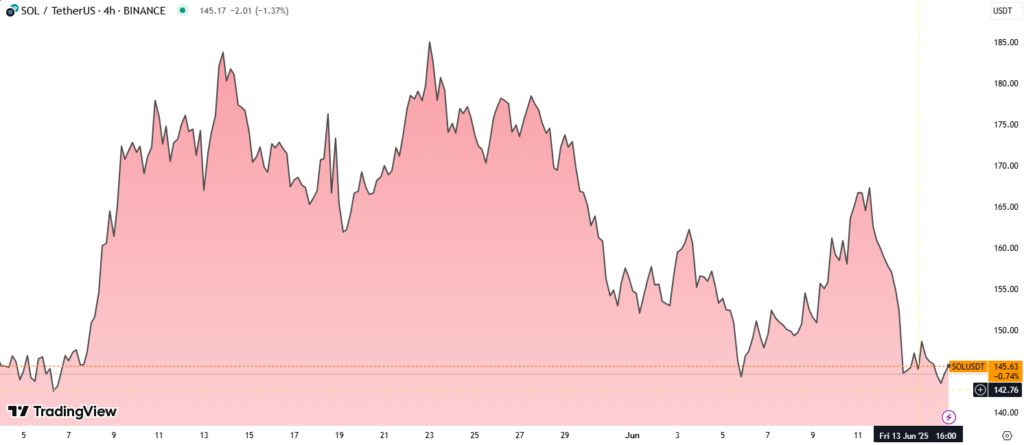

Solana (SOL) traded at $144.14, down 2.06% over the past 24 hours, yet displayed notable resilience by defending the lower end of its $145–$149 consolidation zone. Despite the broader crypto market downturn, institutional confidence in SOL is building through two major developments.

7 Spot Solana ETF Issuers Update S-1 Filings with Staking Support

This week, all seven Solana ETF issuers updated their S-1 filings at the request of the U.S. SEC. These revisions now include staking provisions, a move that aligns with Solana’s native on-chain economics. The updates signal deeper structural integration between institutional products and the Solana ecosystem, increasing long-term appeal for professional investors.

The inclusion of staking mechanisms makes these ETFs more attractive by potentially offering yield generation alongside price exposure, positioning SOL uniquely among major Layer 1 assets.

DeFi Dev Corp Launches $5B Equity Line to Scale SOL Holdings

In another major institutional move, DeFi Development Corp secured a $5 billion equity line of credit (ELOC) to gradually finance SOL acquisitions. This capital structure allows the firm to raise funds without issuing all shares at once, providing flexibility and strategic accumulation.

Currently holding over 609,190 SOL tokens worth more than $97 million, DeFi Dev Corp has emphasized plans to file a resale registration to further expand its holdings. This follows the withdrawal of a previous S-3 filing due to technical eligibility concerns.

Whale Activity Surges Despite Weak Retail Demand

While retail participation has softened, whale wallets moved over $323 million in SOL, indicating strong institutional engagement. Volume spikes and high-volume sell-offs continue to shape intraday price action, with price support holding near $144 and resistance at $149.

Accumulation by large holders below $146 signals long-term bullish positioning, though short-term volatility persists amid broader macroeconomic and geopolitical concerns.