Chainlink CCIP Connects Solana With Coinbase’s Base to Enable Seamless Asset Transfers

The Solana and Base ecosystems are now directly connected through a new Chainlink CCIP-secured bridge, marking a significant advancement in cross-chain infrastructure. The integration opens the door to shared liquidity, native asset transfers, and multichain application development between one of the fastest non-EVM chains and Coinbase’s rapidly growing Ethereumm layer-2.

Chainlink-Powered Interoperability for Solana and Base

Base confirmed that the new bridge is live on mainnet, allowing developers to integrate cross-chain functionality and enabling users to move assets between the networks without complex workflows. The system is secured by Chainlink’s Cross-Chain Interoperability Protocoll, a framework designed to support high-value transfers with strong security guarantees.

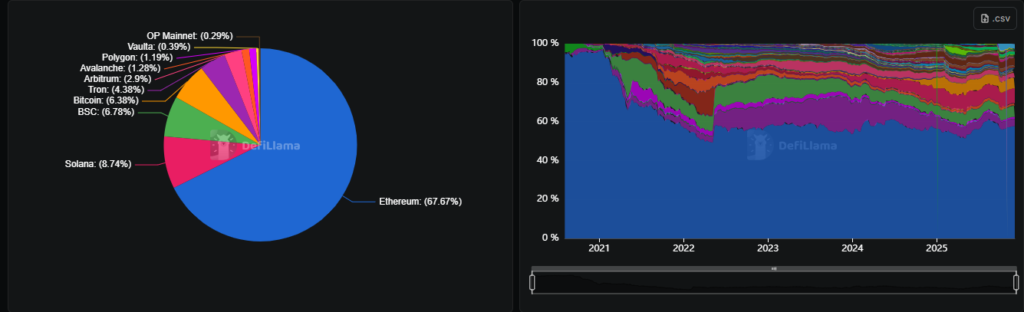

With the bridge active, users can now access Solana assets, including SPL tokens, directly from Base. This also allows Base-based applications such as Aerodrome, Zora, Relay, Flaunch and others to support Solana tokens natively. The connection aims to deepen liquidity across both ecosystems as Solana holds roughly $9 billion in value locked and Base manages about $4.5 billion, according to industry data.

A Technical Step Forward for Multichain Development

The integration is noteworthy because it connects the EVM environment to Solana’s non-EVM architecture, a long-standing challenge in blockchain interoperability. Base’s strategy of becoming a multichain access point aligns with growing user demand for unified experiences rather than maintaining multiple wallets across networks.

Despite the milestone, activity metrics show mixed trends: Solana’s activee addresses have declined from over 6 million in late 2024 to around 2.4 million, while Base has seen falling address counts but rising transaction volume, recently surpassing 407 million monthly transactions.

Token prices showed little immediate reaction. SOL slipped about 3% to below $140, extending its decline from its early-2025 peak. LINK also fell around 3%, trading near $14 despite ongoing developments around Chainlink’s institutional products.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.