Solana (SOL) faces renewed selling pressure after breaking key support near $156, even as the token recorded over $336 million in ETF inflows last week, highlighting investor uncertainty amid market volatility.

Solana’s price declined by 4.9% to $153.49 on Tuesday, extending a multi-day pullback despite strong institutional inflows. Market data shows that investors poured $336 million into Solana-linked exchange-traded funds over the past week, signaling continued demand. However, technical weakness and token unlocks have sparked renewed short-term bearish momentum, pulling the price toward the $152.80 demand zone.

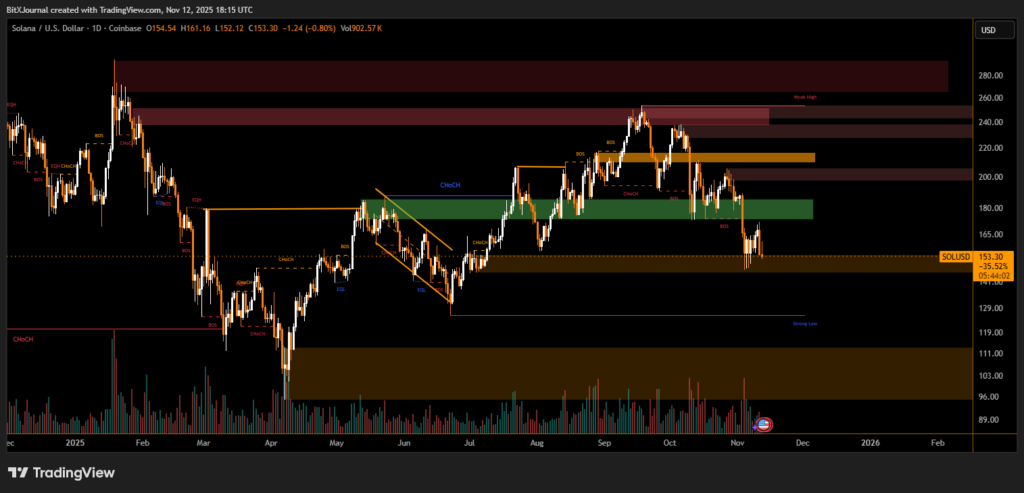

The technical setup on Solana’s daily chart shows a break of structure (BOS) below the $156 support level, a key threshold that had previously held through multiple tests in October. The breakdown coincided with increased selling volume, suggesting that short-term traders are taking profits ahead of potential volatility.

Adding to market pressure, Alameda Research reportedly unlocked 193,000 SOL tokens, valued at approximately $30 million, further contributing to sell-side liquidity. BitXJournal Analysts note that such large token movements tend to weigh on sentiment, especially when the broader market shows signs of risk aversion.

“The short-term outlook for Solana hinges on whether it can defend the $150–$152 range,” said BitXJournal crypto market analyst. “A sustained move below that could open the door toward the next demand zone near $141, while a quick recovery above $160 might attract fresh buying interest.”

Despite the pullback, long-term investors remain optimistic about Solana’s network fundamentals. The blockchain continues to see strong developer activity and growing ecosystem participation, positioning it as a leading competitor among Layer-1 networks. Still, traders are watching for confirmation of a trend reversal, as the asset remains below several key resistance zones near $175 and $200.

With Solana hovering near $153, the market faces a critical juncture between continued correction and potential recovery. The combination of ETF inflows and increased token supply reflects a divergence between institutional accumulation and short-term selling, setting the stage for heightened volatility in the days ahead.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.