Solana Technical Analysis Shows Signs of Stabilization

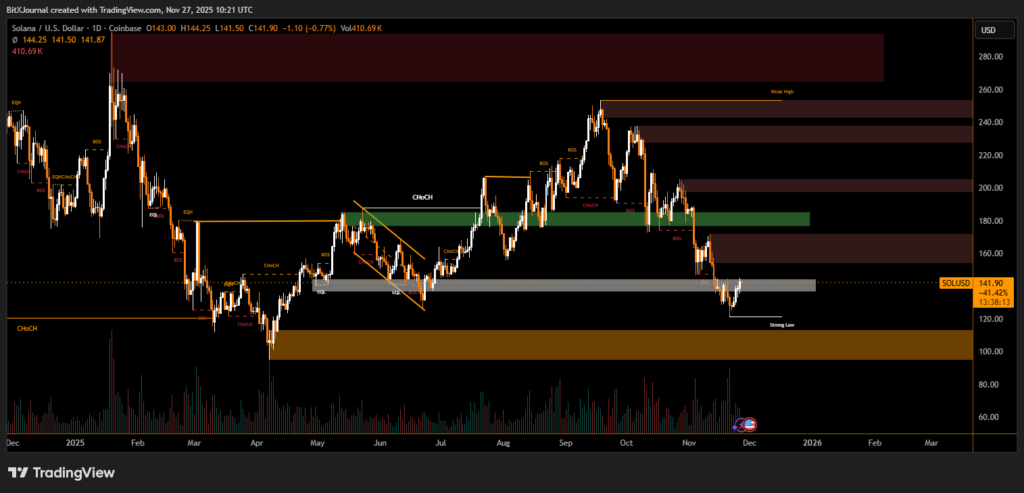

Solana (SOL) has reclaimed the $140 level after a period of sharp decline, offering a tentative signal that buyers may be attempting to establish a short-term floor. A review of the recent daily chart suggests that market structure shifts, liquidity zones, and reaction points are beginning to align for a possible relief move—though major resistance remains overhead.

After weeks of sustained downward pressure, Solana’s price action has bounced from a previously mapped strong low region around the mid-$130s. The chart shows a clean interaction with a historical demand block, triggering a mild rebound. While not yet indicative of a full trend reversal, the reaction is notable given the broader market’s cautious mood.

Market Structure and Key Levels

The market shows multiple Break of Structure (BOS) and Change of Character (ChoCH) signals through the year, reflecting the turbulent and trend-shifting environment. Recently, price dipped into a major liquidity pocket below prior equal lows before sharply reacting upward.

BitXJournal Technical analyst highlights this reaction:

“The bounce from the lower demand region shows that buyers are still defending key structural levels, but the momentum is not yet sufficient to break higher-timeframe supply,” said one digital-asset market strategist.

The nearest resistance now sits around the $150–$160 zone, an area marked by previous consolidation and supply imbalances. A decisive reclaim could open doors toward $180, where a larger distribution block is visible.

BitXJournal technical analyst noted:

“SOL needs a clean BOS on the daily timeframe above the supply zone to re-establish a bullish narrative. Until then, the market is likely to remain range-bound.”

Solana’s rebound above $140 provides early signs of stabilization, but the broader trend remains neutral-to-bearish unless price can conquer the overhead supply zones. Traders will be watching volume profiles, structural breaks, and liquidity sweeps closely in the coming sessions.

The current reaction offers opportunity—but also caution—as SOL navigates a dense region of technical traffic.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.