Solana finds strong demand zone after recent correction

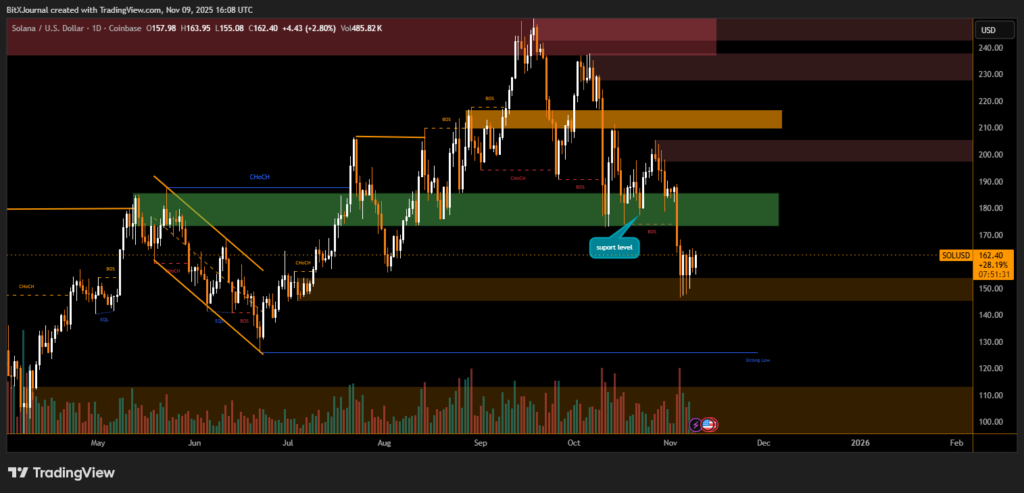

Solana (SOL) has stabilized above a key support level around $150, signaling that the recent sell-off might be losing momentum. After falling sharply from the $190 region, the token is showing early signs of a technical rebound, supported by renewed buying pressure on higher timeframes.

According to market structure data, SOL has defended a high-volume demand zone visible between $145 and $160, where prior accumulation phases occurred earlier in the year. Market also highlights a Change of Character (CHoCH), a pattern often marking a shift from bearish to bullish sentiment.

Bullish reversal patterns emerging

The Break of Structure (BOS) observed last week suggests that short-term sellers may be exhausted. Analysts note that maintaining price action above $155–$160 could pave the way for a retest of the $175–$185 resistance zone, an area where supply historically capped previous rallies.

“The market is testing an area of interest where buyers previously stepped in aggressively,” BitXJournal crypto market analyst said. “If Solana continues to close daily candles above $160, momentum could shift decisively toward the upside.”

Technical outlook points to cautious optimism

On the downside, traders are watching the $140–$145 range, labeled as a strong low on the chart. A breakdown below this level could reopen the path toward deeper retracement targets near $120. However, current volume profiles suggest buyers are defending key liquidity zones, reducing immediate downside risk.

For now, Solana remains within a consolidation channel, with bulls attempting to reclaim control after a series of bearish breaks. The next few sessions will likely determine whether the asset can sustain its recovery or face renewed selling pressure.

With on-chain activity rising and sentiment improving across major altcoins, Solana’s resilience at current levels could signal a broader shift in market tone heading into late Q4 2025.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.