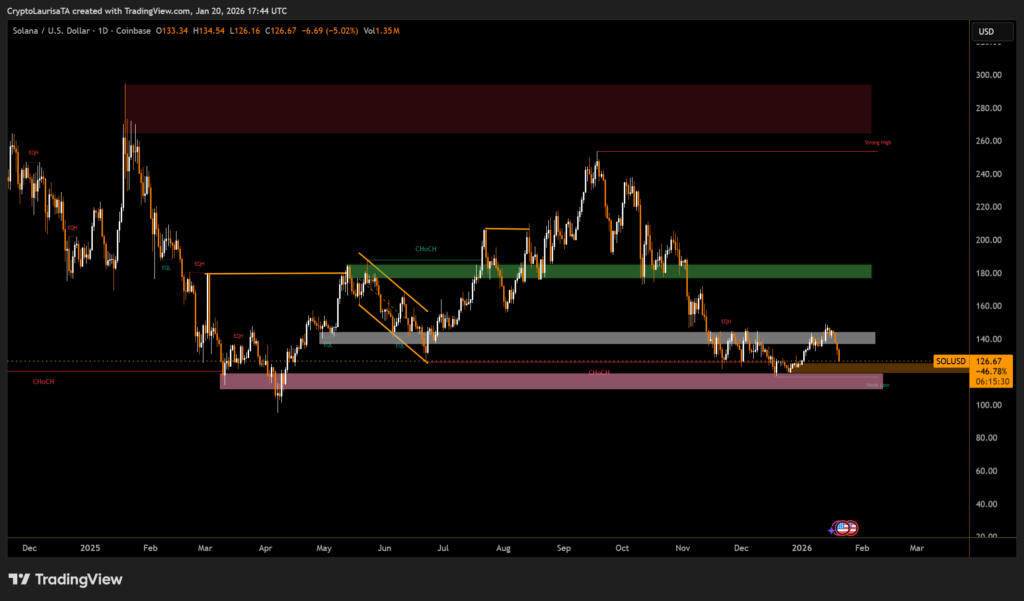

Solana slipped below the $130 level for the first time since early January, reflecting a broader market pullback. Despite the price decline, onchain indicators suggest that SOL’s underlying fundamentals remain resilient, with accumulation trends and network activity pointing toward a potential recovery.

SOL fell to around $126, triggering concern among short-term traders. However, onchain data shows that large holders continue to accumulate, using recent weakness as a buying opportunity. Wallets holding between 1,000 and 10,000 SOL have steadily increased their balances since late 2025, now controlling approximately 48 million SOL, or about 9% of the circulating supply.

This sustained accumulation highlights strong conviction among whales, even as prices trend lower.

Another supportive signal comes from exchange data. The amount of SOL held on centralized exchanges has dropped to its lowest level in nearly two years. A declining exchange balance typically suggests reduced sell-side pressure, as more tokens are moved into long-term storage rather than positioned for immediate sale.

Solana’s onchain activity has also shown signs of recovery, with higher transaction volumes and increased network usage boosting demand for SOL. Rising utility often precedes price stabilization, especially during corrective phases.

While short-term volatility persists, the combination of whale accumulation, falling exchange supply, and improving onchain metrics suggests Solana may be positioning for a rebound once broader market conditions stabilize.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.