Solana (SOL) is currently trading at $128.59, marking a modest daily decline of around 0.09%. This price action comes amid broader market volatility and increased global uncertainty. The altcoin has experienced significant intraday movement, with lows of $127.03 and highs of $140.90, reflecting investor caution.

Solana Faces Key Support at $138–$140

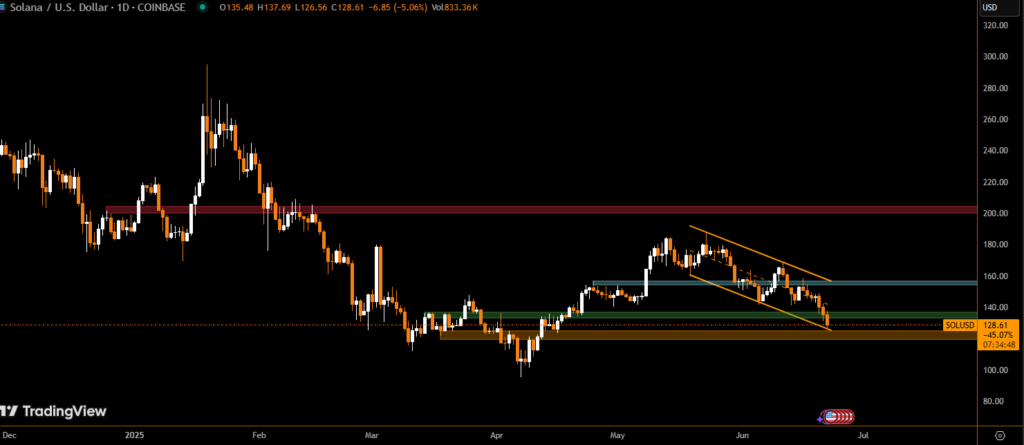

Despite the dip, technical indicators highlight the $138–$140 zone as a major support area. If this level holds, Solana could potentially stage a rebound toward the $160–$180 range. However, failure to maintain support may result in a decline toward $123 or even $116, a critical mid-term risk level.

Market analysts note that Solana recently formed a descending channel, facing resistance at $142.65–$144. A breakout above this zone is needed for bulls to regain momentum.

A drop below $140 would signal bearish continuation, while a close above $147 could open the path to $160+.

Whale Activity and Institutional Interest Remain Strong

While short-term price pressure remains, institutional sentiment toward Solana is still growing. Notably, Canadian-based firm Sol Strategies, which manages over 420,000 SOL (valued over $61 million), has filed to list on Nasdaq. This move highlights confidence in Solana’s long-term adoption potential.

Additionally, ecosystem upgrades such as wrapped Bitcoin (wBTC) integration and new DeFi projects continue to expand Solana’s utility. Analysts believe these fundamentals could drive future price appreciation once market sentiment stabilizes.

Price Outlook: Bullish and Bearish Scenarios

| Trend | Trigger | Price Target |

|---|---|---|

| Bullish | Break above $144 resistance | $160 to $200 |

| Bearish | Break below $140 support | $123 to $116 |

Solana’s short-term trend remains neutral to bearish, but technical and fundamental signals suggest strong recovery potential if key resistance is broken.

Conclusion

Solana is consolidating near a crucial support level around $128–$140, with potential for both rebound and further correction depending on market conditions. Institutional interest and ecosystem growth provide a strong long-term case, but short-term traders should monitor the $140 threshold closely.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.