SOL Falls Below Key $160 Level Amid Broader Market Correction

Solana (SOL) slipped more than 5.3% in the past 24 hours, falling from $163.72 to $154.99, as global macroeconomic fears and declining memecoin activity weighed heavily on the token’s performance. The drop pushed SOL below its critical $160 support zone, raising concerns among traders about sustained bearish pressure.

The downturn mirrors a broader market correction sparked by the U.S. Court of International Trade’s reversal of the Trump-era tariff suspension, reviving U.S.-China trade tensions and sparking a wave of risk-off sentiment across crypto markets.

Memecoin Hype Fizzles on Solana

Solana’s network has seen a noticeable decline in revenue from memecoin platforms, most notably Pump.fun, which drove significant transaction volume earlier in the year. Since April, activity on such platforms has dropped sharply, removing one of Solana’s key on-chain catalysts.

“Memecoin activity was a major revenue stream for Solana,” analysts noted. “Without it, network engagement—and token momentum—have taken a hit.”

Solana AppKit Launches to Boost Developer Ecosystem

Despite the price slump, Solana Labs announced the launch of the Solana AppKit on Friday—a move intended to re-energize its developer community. The open-source React Native toolkit allows mobile app developers to build fully functional iOS and Android apps on the Solana blockchain in just minutes.

The AppKit supports 18+ protocols, integrates embedded wallets via Privy, Dynamic, and Turnkey, and offers copy trading, direct swaps, and integration with Jupiter Exchange, Raydium, and Pump.fun.

“This could set the stage for a new wave of user-focused apps in Solana’s mobile ecosystem,” said Solana Labs.

Technical Outlook: Bearish Trend Persists

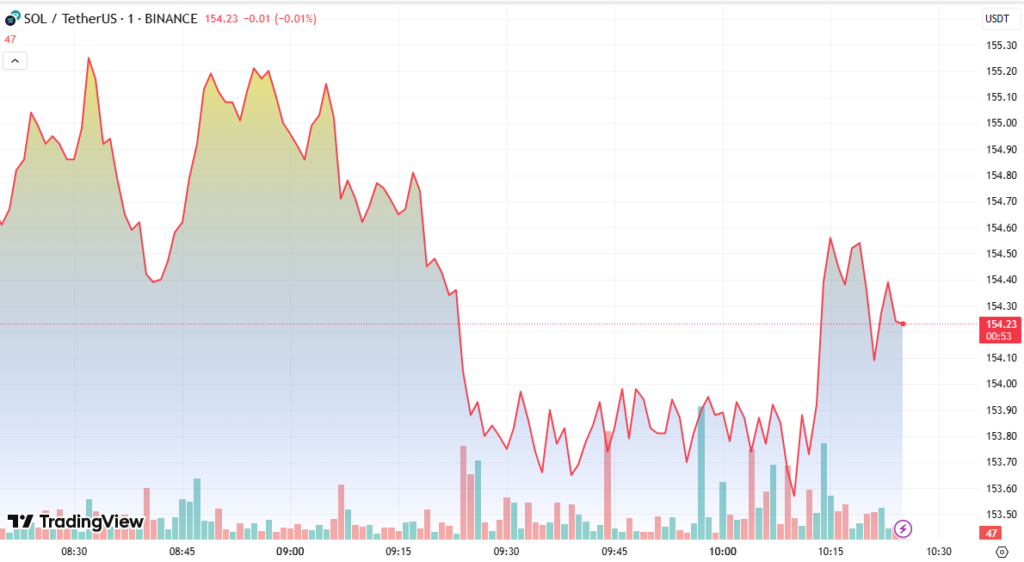

Key technical data shows:

- Price decline: $163.72 → $154.99 (5.33%)

- Resistance: $161.84 (with 2.52M sell volume)

- Support: $152.37 (with 1.81M buy volume)

- Volatility range: $11.87 (7.24%)

The pattern of lower highs and lower lows continues, suggesting a bearish short-term trend. A minor bounce occurred at $154.37, reaching a modest recovery to $155.36, but buyers must reclaim $157+ for momentum to shift.

What’s Next for SOL?

As traders monitor SOL’s ability to hold above $152–$155, the market’s attention will stay on memecoin dynamics, macro risks, and the adoption of Solana’s new developer tools. Until new catalysts emerge, bearish sentiment may linger.

“If network activity doesn’t pick up soon, SOL could face further downside pressure,” warn analysts.