Solv Protocol has unveiled BTC+, a structured yield vault designed to help institutional investors earn returns on Bitcoin holdings that would otherwise sit idle. With over $1 trillion in BTC not currently generating interest, the platform aims to fill a growing market gap for secure, yield-generating Bitcoin strategies.

BTC+ Targets DeFi, CeFi, and Real-World Asset Yields

Solv’s BTC+ vault aggregates Bitcoin capital and deploys it across a mix of decentralized finance (DeFi), centralized finance (CeFi), and traditional finance (TradFi) markets. Yield sources include:

- Protocol staking

- Basis arbitrage

- Tokenized real-world assets, such as BlackRock’s BUIDL fund

The vault integrates Chainlink’s Proof-of-Reserves for transparent, onchain asset verification and includes net asset value (NAV)-based safeguards to reduce downside risk—mirroring practices common in private equity funds.

“Bitcoin is one of the world’s most powerful forms of collateral, but its yield potential has remained underutilized,” said Solv co-founder Ryan Chow.

Institutional Demand for Bitcoin Yield is Surging

Solv joins a wave of firms addressing the rise in institutional demand for Bitcoin yield products. In recent months:

- Coinbase launched a Bitcoin yield fund outside the U.S. offering up to 8% annual returns via cash-and-carry arbitrage.

- XBTO and Arab Bank Switzerland partnered to offer BTC option-premium yields with returns near 5% annually.

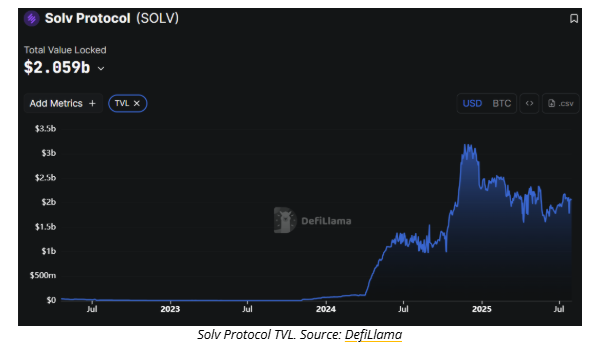

Solv’s protocol already commands over $2 billion in total value locked (TVL), according to DefiLlama, positioning it as a leading DeFi platform entering the Bitcoin yield space.

Bitcoin’s Financialization Accelerates

Since the SEC’s spot Bitcoin ETF approval in January 2024, institutional adoption has exploded. Bitcoin is now seen not just as a store of value, but as a productive asset.

From JPMorgan accepting Bitcoin ETFs as collateral to federal agencies evaluating BTC’s role in mortgage risk assessments, the tide is turning.

The rise of structured Bitcoin yield strategies like Solv’s BTC+ marks a pivotal step in Bitcoin’s evolution as a mainstream institutional asset.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.