Recent discussions around a possible merger involving SpaceX, Tesla, or Elon Musk’s artificial intelligence venture xAI have drawn attention to a significant but often overlooked factor: their combined bitcoin holdings. Together, SpaceX and Tesla control close to 20,000 BTC, positioning the group among the world’s largest corporate holders of the digital asset.

Corporate Bitcoin Holdings Under One Structure

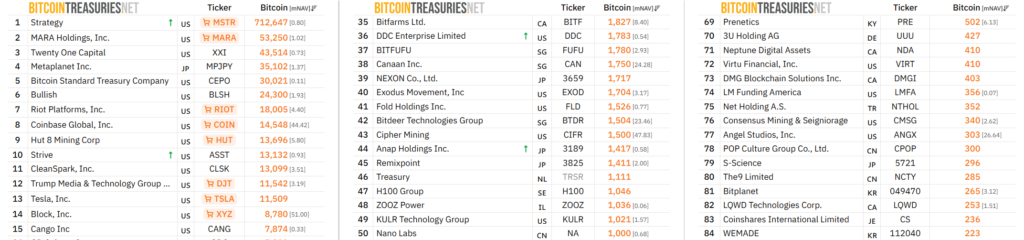

Based on public disclosures, SpaceX holds approximately 8,285 bitcoin, accumulated since early 2021. Tesla, a publicly listed company, holds around 11,509 bitcoin and reported no change to that balance in its most recent quarterly filing. At current market prices, the combined value is estimated at about $1.7 billion.

If a merger were to move forward, these assets would fall under a single corporate structure. While this would not affect bitcoin’s underlying market dynamics, it would concentrate governance, accounting treatment, and disclosure requirements for one of the largest corporate bitcoin positions globally.

Accounting, Volatility, and Investor Scrutiny

Tesla’s bitcoin is subject to fair-value accounting, meaning price fluctuations directly impact reported earnings. In late 2025, the company recorded a substantial after-tax loss as bitcoin prices declined sharply during the quarter. SpaceX, as a private company, has so far avoided similar public earnings volatility.

As SpaceX considers a future IPO, potential investors are likely to examine crypto exposure more closely. The merger talks underscore how bitcoin has become embedded in major technology firms, even when it is not central to their core business strategies.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.