Spark has introduced two new products, Spark Prime and Spark Institutional Lending, aimed at expanding the role of onchain stablecoins in institutional credit markets. The decentralized asset allocator is positioning its lending infrastructure as a bridge between decentralized finance liquidity and traditional institutional borrowers.

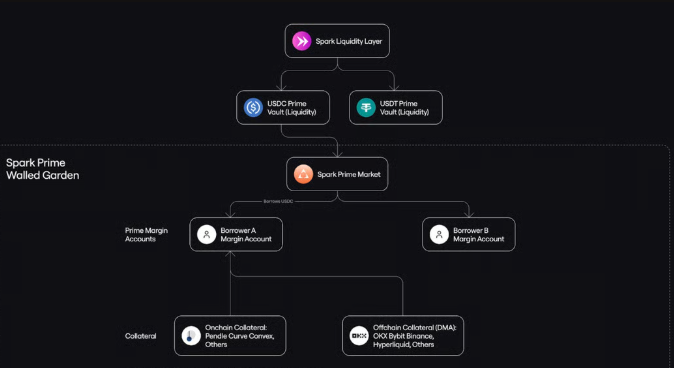

Spark Prime is structured as a margin-style lending platform with off-exchange settlement, powered by Spark’s internal liquidity engine. The product is designed to provide stablecoin credit without requiring institutions to directly manage DeFi infrastructure. Early partners include Edge Capital, M1 and Hardcore Labs. Initial allocations for Spark Prime stand at approximately $15 million, with gradual expansion planned as additional risk controls are implemented.

Spark Institutional Lending connects Spark-governed liquidity pools with regulated custodians such as Anchorage Digital. This allows institutions to retain collateral within compliant custody frameworks while accessing stablecoin credit lines.

DeFi Liquidity, TVL and Market Context

Spark’s total value locked currently stands at $5.24 billion, down from a peak of $9.2 billion in late 2025, according to DeFi Llama data. The broader DeFi market holds roughly $96.52 billion in total value locked, reflecting a decline of about 20% amid recent market volatility.

The company has also played a significant role in stablecoin liquidity deployment. It has supplied more than 80% of USDC liquidity for Coinbase’s Bitcoin-backed loan market on Morpho, contributing to approximately $500 million in loan growth during its first quarter. Additionally, around $500 million in Spark-governed liquidity has supported PayPal’s PYUSD stablecoin markets.

By combining transparent onchain reporting with regulated custody integrations, Spark is testing whether institutions are ready to scale stablecoin-based credit into the billions.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.